Samsung shares hit a three-year high on Friday after the South Korean tech giant forecast a 15-fold increase in its second quarter operating profit from the same time last year, as the global artificial intelligence boom buoys demand for advanced computer chips.

Samsung shares hit a 3 year high.

AFP via Getty Images

Key Takeaways

- Shares of Samsung Electronics in Seoul, the flagship entity of the South Korean Samsung Group conglomerate, climbed 3% on Friday, reaching 87,100 Korean won per share (around $63) at market close.

- It marks the highest peak for Samsung Electronics shares since early January 2021 and comes after the company issued profit guidance for the second quarter of this year.

- Samsung said it expects to make around 10.4 trillion Korean won in profit for the second quarter of 2024, or around $7.5 billion.

- The figure, up from 670 billion won (around $500 million) a year earlier, smashed analysts’ expectations and marked a 15-fold increase from a year ago, as well as comfortably beating first quarter profits of 6.61 trillion won ($4.8 billion).

- Samsung said it expected to rake in 60 trillion won ($43.5 billion) in sales revenue during the second quarter of this year, a jump of nearly a quarter from the same time last year.

What To Watch For

Samsung has not released much information on its expected second quarter takings but the impressive forecasts are most likely down to strong performance in its semiconductor unit. Samsung is one of the world’s largest computer chip manufacturers and booming demand for artificial intelligence has sent prices for chips skyrocketing, particularly high-end chips that can be used to power AI products and data centers.

Samsung itself has attributed its expected growth this year to broader AI optimism, and in particular interest in generative artificial intelligence, or the kind of AI powering tools like ChatGPT, Gemini, Claude and Copilot.

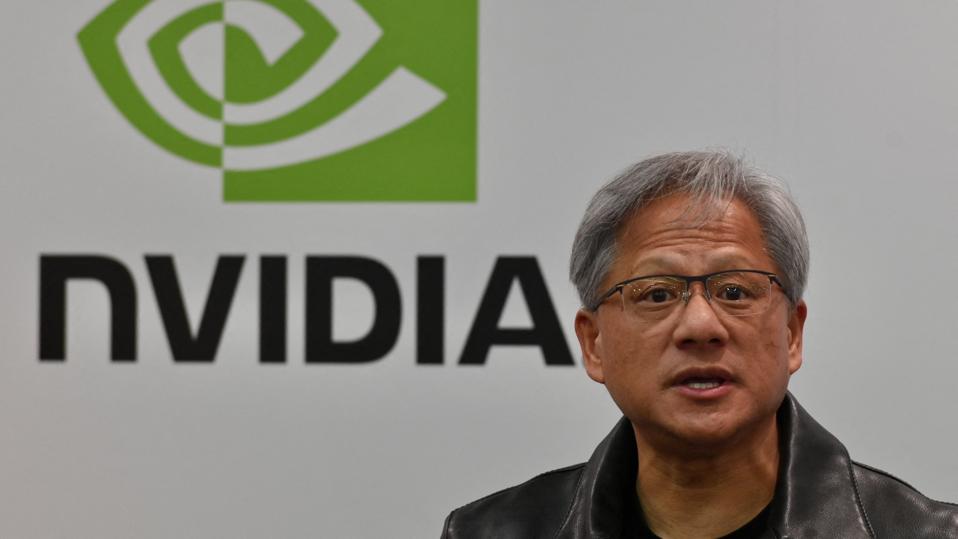

As well as helping Samsung recover from a tough COVID-19 pandemic slump, the AI boom has propelled other chip and AI companies to stratospheric heights. Notable among these is U.S. chipmaker Nvidia, which has rapidly grown from a relatively niche maker of hardware primarily used by gamers to one of the world’s most valuable companies with a market capitalization of more than $3 trillion.

Nvidia was briefly the world’s most valuable public company by market capitalization, though it is now the third most valuable behind Microsoft and Apple.

What To Watch For

Samsung is due to release a more detailed earnings report for its second quarter at the end of July.

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 30, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.