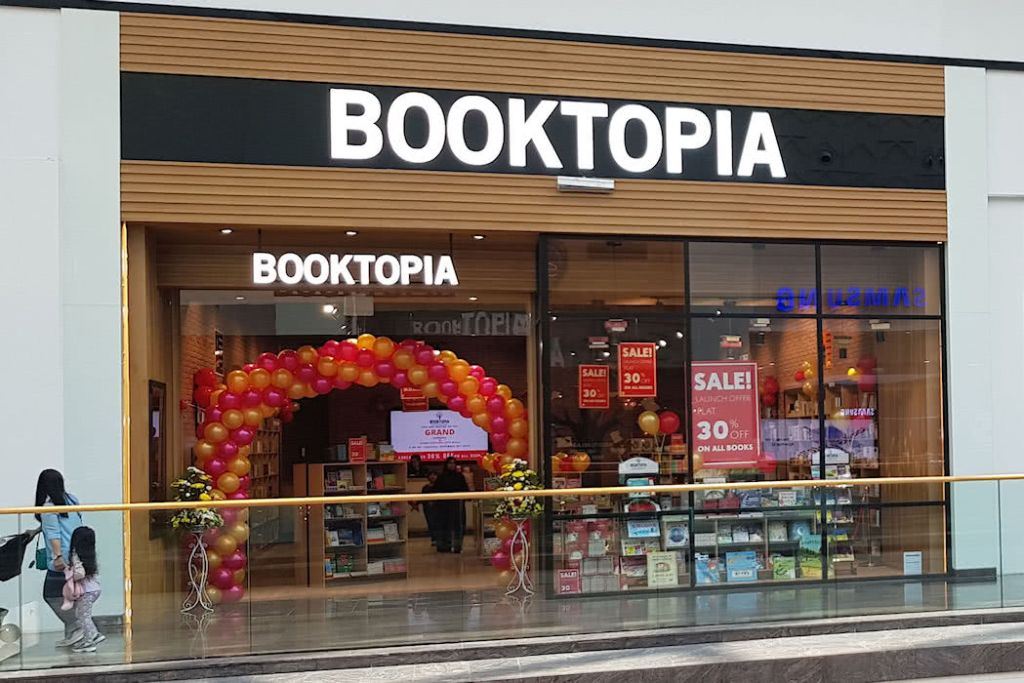

20-year-old online book retailer, Booktopia, which went public on the ASX in 2020, is on the brink of collapse.

Booktopia has entered voluntary administration after the cash-strapped online book retailer failed to secure funding to improve its liquidity.

In a statement to the Australian Securities Exchange (ASX), McGrathNicol Restructuring said it had been appointed as the voluntary administrator of Booktopia Group and its subsidiaries, and would urgently undertake assessment of the company’s business while options for its sale or recapitalisation were explored.

Booktopia was founded in 2004 and went public on the ASX in December 2020, raising $43.1 million at $2.30-a-share, with a market capitalisation of $315.8 million.

But the company took a turn when it decided to move to a new automated fulfilment centre in South Strathfield, which hampered the company’s sales as its inventory and logistics took a hit. It coincided with a sharp decline in the overall book sales market.

What followed was a series of high-level resignations, with co-founder Tony Nash ousted as CEO in early 2022, and months later, CFO Fiona Levens resigned. (Nash’s successor, CEO David Nenke, also resigned).

In its 2023 annual report, the company said revenue had tanked about 18% to $197.6 million on 6.8 million units shipped. Its underlying EBITDA had declined 173% to $4.6 million, and there was a statutory NPAT loss of $29 million.

On Friday, 13 June this year, the company entered a trading halt, expecting to announce it had secured funding the following Monday. That deadline was extended three times to 19 July.

“The timetable for coming out of suspension is predicated on the form any potential funding takes, and the company expects it will be in a better position to advise on the viability and form of that funding by 19 July 2024,” the company said in a statement at the time.

And it flagged just how crucial that funding was: “In its opinion, the continued trading of the Company’s securities is likely to be materially prejudicial to its ability to seek support from various parties and to obtain necessary funding.”

At the time of the company’s trading halt, shares were worth about $0.045, bringing its overall market cap to about $10.3 million.

The first statutory meeting of creditors will take place by Monday, 15 July.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 15, 2024.