Forager Funds senior investment analyst Chloe Stokes explains why looking at a business from every angle is critical to getting the highest returns.

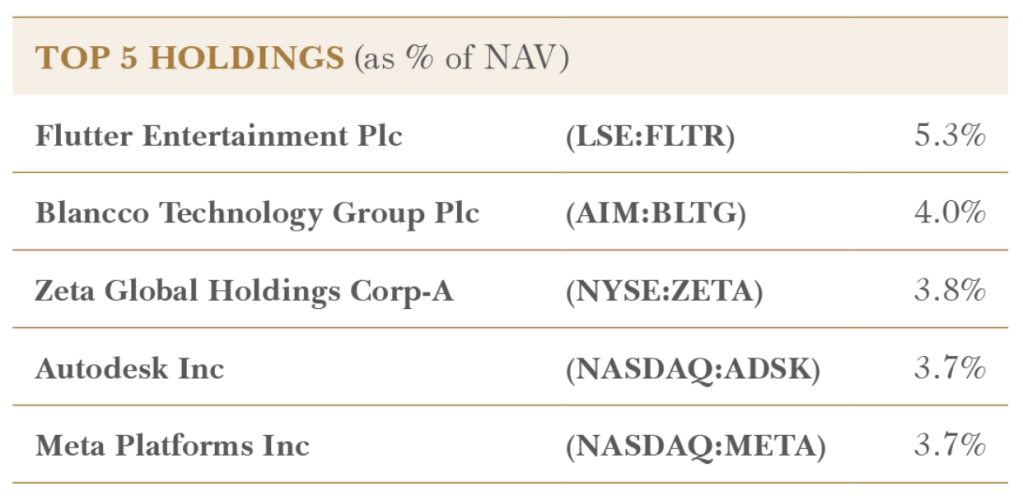

Forager International Shares Fund top five holdings 30 September 2022

The United Kingdom is in economic and political turmoil, with the highest inflation rate in 40 years and record low exchange rates of the pound against the US dollar. Its third prime minister in two months assumed office in October and Brexit is likely to continue to serve as a destabilising force long into the future.

But for Chloe Stokes, the instability creates investment opportunities. As senior investment analyst in international funds at Forager Funds, Stokes is searching for stocks outside Australia that are undervalued. Volatility has become something of a mainstay of UK markets, and that results in price fluctuations she will seize on.

“There has been extra levels of uncertainty in the UK compared to other places in the world,” she says. “Its financial markets have dramatically underperformed for more than two decades. When there’s uncertainty, people don’t want to pay as much for businesses or stocks.”

A business may be undervalued for a variety of reasons: it’s Stokes’ job to understand why. There could be wider market dysfunction, when pessimism is the prevailing sentiment and “people are just selling everything.” The impact of macro-economic factors on a particular business may have been over-emphasised. Perhaps it is a new business model that many are unfamiliar with. Or Stokes may perceive accounting differences in certain types of businesses that are not fully comprehended by the broader market. When she hits upon what she describes as an “informational advantage”, she strikes.

“We’re not investing in the UK for the sake of investing in the UK,” she says. “We find specific businesses that we think are going to fare well over the medium to long term.”

For example, while the low valuation of the British pound has a negative impact on UK businesses with a US dollar cost basis, it is a benefit for those with a significant portion of revenue outside the UK. However, this may not be reflected in the price of a particular stock.

“If you wait until things are looking really rosy, you’ll likely be too late.”

– Chloe Stokes, Forager Funds

Having the confidence to seize upon a situation when conditions are less than ideal is part of what underpins Stokes’ success. She quotes the well-known British value investor, Jeremy Grantham, who says: “The tide doesn’t turn when there’s light at the end of the tunnel. The tide turns when it’s pitch black, but it’s just a shade less black than the day before.”

“Grantham said this in March 2009, as the world economy was staring down the prospect of another Great Depression,” says Stokes. “Six months later, the S&P 500 was up more than 50% and Australia’s all ordinaries was up nearly as much – but it wasn’t until well into 2010 when the risk of economic meltdown had subsided. All these gains came before the coast was clear.”

Stokes finds the quote especially pertinent in today’s tough economic climate. Many investors tell her that they would prefer to wait until there is more clarity on inflation and interest rates before putting their money into equities. Her advice is to seize the moment.

“If you wait until things are looking really rosy, you’ll likely be too late. I’m not saying that things can’t get worse. We have no idea if the worst is behind us yet. But the more perceived uncertainty there is, the more opportunities we typically find. The second the uncertainty disappears, the opportunity tends to disappear with it.”

On the question of interest rates, Stokes believes that equities are a sound way of protecting wealth in real terms, because over the long-term they deliver significantly higher returns than inflation.

Any sector, anywhere

Like all Foragers’ analysts, Stokes has an unconstrained mandate, which means she can invest in any sector anywhere in the world outside of Australia. Other funds often have some kind of constraint around the liquidity of a stock or its size, or being required to invest in a particular sector, or in a business that is already profitable or growing.

“I love that we can invest in whatever we like,” she says. “It means that I can move around as the markets move.”

It is a high-pressure environment and Stokes works long hours because her focus is mostly on the UK, Europe and the United States. Earnings periods can be brutal. Last week, for example, she had a company in the United States reporting its results. She got the results at around 10pm and then jumped on an earnings call from 11.30pm to 12.30. She was back at her desk by 7am.

“Australian stocks are quite niche, whereas I can invest in big brands that are well-known and loved. For me, it’s all about the variety.”

– Chloe Stokes

Stokes is often asked if she would prefer to set her sights on stocks on home soil, because the hours would be so much better. She doesn’t hesitate to say that she is happy where she is.

“The biggest difference for me is the opportunity to invest in all the different types of businesses that exist overseas. Australian stocks are quite niche, whereas I can invest in big brands that are well-known and loved. For me, it’s all about the variety.”

Forager manages funds worth around $320 million and it is an inherently high-pressure environment. Stokes thrives in the fast-paced world of funds management. She completed a Bachelor of Business with a major in accounting and finance, and previously worked at Big Four firms Deloitte and KPMG, but it wasn’t the right fit. After joining Forager in 2017, Stokes threw herself into combing through annual reports.

“I love going through the financials to work out what makes a business succeed or fail. There’s no more accurate feedback loop than in picking stocks for a fund. You have to be intellectually honest. The market is going to give you feedback on your decisions.”

Stokes is always looking for new ideas, part of which involves having robust discussions with the CEOs and CFOs at listed companies about the intricacies of their organisation.

“I can ask them anything that I want, and they will tell me what they think about the business, the industry and the financials,” she says. “Having access to these very intelligent people is something that I really love about my job.”