Novo Nordisk is now worth more than Elon Musk’s electric vehicle giant Tesla, after shares of the Danish maker of Ozempic surged following the release of promising results for an oral weight loss treatment.

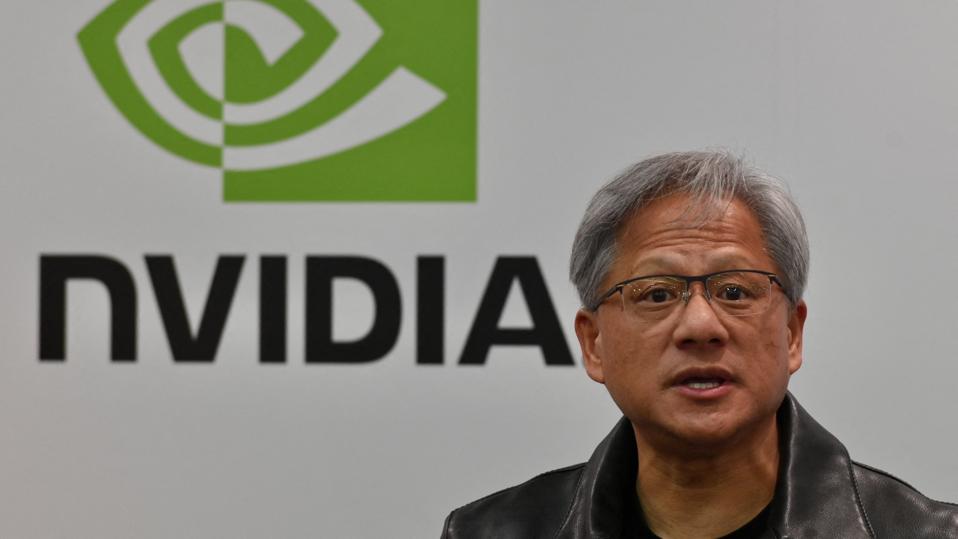

Elon Musk, Wegovy user and Tesla CEO.

Getty Images for The New York Times

Key Takeaways

- Novo Nordisk’s market capitalization surged Thursday to about $610 billion after its stock gained 10% to a record high, after the pharmaceutical firm shared that participants in a trial for an experimental amycretin pill lost 13% of their body weight over 12 weeks, more significant weight loss than Novo Nordisk’s wildly popular semaglutide injectable drugs like Wegovy.

- Meanwhile, Tesla shares rose less than 1%, bringing its market cap to about $560 billion and slimming its year-to-date loss to a still hard-to-swallow 29%.

- It’s the first time since early 2020 that Novo Nordisk’s market value topped Tesla’s, according to YCharts data.

- The changing of the guard signals a dramatic shift in market sentiment, as Tesla’s $1.1 trillion market cap at the end of 2021 was four times higher than Novo Nordisk’s $255 billion valuation.

- That reflects investors broadly souring on electric vehicles and flooding into stocks of pharmaceutical firms like Novo Nordisk and its American rival Eli Lilly poised to profit off of the intensifying interest in weight loss drugs.

Crucial Quote

The market is “euphoric” on artificial intelligence and weight loss drugs “but not much else,” Bank of America’s top U.S. strategist Savita Subramian wrote in a note to clients last week, pointing to the limited breadth across equity markets.

Key Background

Eli Lilly, which makes the FDA-approved injectable weight loss treatment Zepbound, overtook Tesla in market value earlier this year. Novo Nordisk’s Wegovy is FDA-approved for weight loss, while its lower-dose GLP-1 cousin Ozempic is only officially approved for Type 2 diabetes but is often prescribed off-label for weight loss. Both Eli Lilly and Novo Nordisk have enjoyed explosive earnings growth thanks in large part to the surging popularity of their weight loss drugs: Lilly’s overall sales rose 28% and net income rose 18% during its most recent quarter on an annual basis, while Novo’s revenues jumped 36% and profits spiked 60%.

Tesla reported 3% annual revenue growth and a 40% decline in profits during 2023’s final quarter. The net worth of Tesla’s CEO Musk has plunged by more than $120 billion since Nov. 2021, when his fortune peaked as shares of his company did, according to Forbes’ calculations.

Surprising Fact

Musk said in 2022 he used Wegovy for weight loss.

This article was first published on forbes.com and all figures are in USD.