Shares of Super Micro Computer nosedived Friday as an analyst threw some cold water on the U.S.’ hottest stock, but shares of the company viewed as among the top pure artificial intelligence plays remain up an eye-popping level.

Key facts

- Super Micro’s stock fell 20% to just above $800, notching its sixth-steepest daily percentage loss in its 17-year history on the open market and its worst day since August 2023.

- Even after Friday’s selloff, shares of Super Micro are up an absurd 181% year-to-date, the third-best rally of any of the U.S.’ 3,000 largest stocks, and 770% over the last 12 months, the best gain of any major American stock.

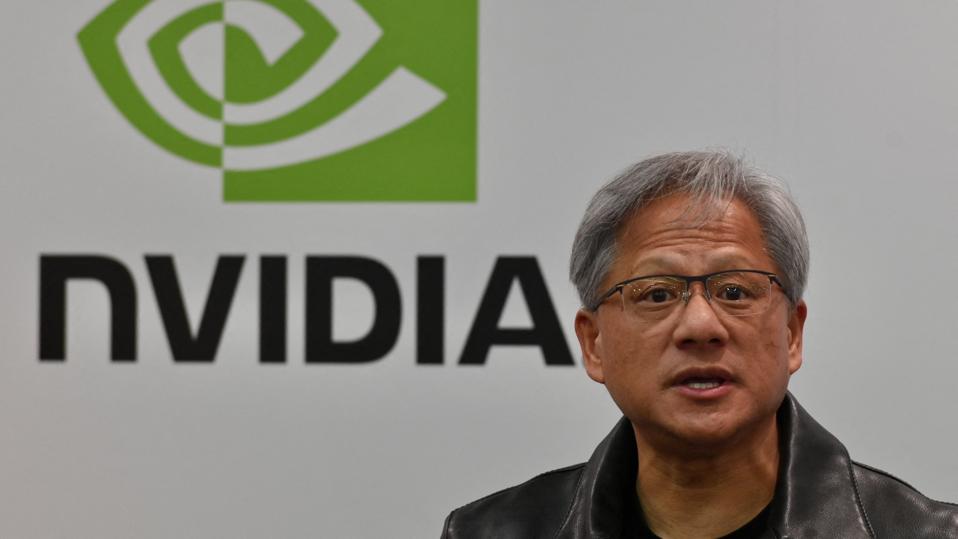

- The downswing for Super Micro, which makes the high-power data servers necessary for generative AI and counts like the likes of Nvidia and Intel as major customers, coincided with a note from Wells Fargo analyst Aaron Rakers initiating coverage of Super Micro with a neutral rating, noting the stock’s runup largely prices in the “remarkable” earnings potential for the firm.

- Still, Wells Fargo’s $960 price target implies almost 20% upside from Super Micro’s Friday share price, indicative of the growing institutional support for the previously little-discussed Silicon Valley firm after Bank of America initiated coverage for Super Micro on Thursday with a $1,040 target.

- Super Micro has a 10% market share of AI servers, according to Bank of America, which estimates Super Micro’s share to grow to 17% within three years as the market for AI servers expands by roughly 150%, resulting in the lofty valuation for Super Micro.

Crucial quote

Rosenblatt analyst Hans Mosesmann dubbed Super Micro “the Switzerland of AI” in a note to clients last month, likening the company’s ability to capitalize regardless of who comes out on top in the ongoing AI tug-of-war to the conflict-neutral European nation.

Big number

More than $10 billion. That’s how much market value Super Micro lost Friday.

Its market capitalization is still more than $40 billion higher than it was at the end of 2022, exploding from $4 billion to $45 billion.

Tangent

Arm Holdings, the British semiconductor chip designer which has enjoyed a similar rally in recent weeks due to AI optimism, also slumped Friday, with shares falling 5%.

Arm’s more than 80% rally this year, which sent its valuation to over $100 billion, outpaces any stock listed on the S&P 500, topping S&P pacesetter Nvidia’s roughly 50% gain.

This article was first published on forbes.com and all figures are in USD.