Shares of Robinhood jumped more than 4% Friday morning after the online brokerage bought back more than US$605 million in company stock that had been owned by indicted former FTX head Sam Bankman-Fried and seized by the federal government after his high-profile fall from grace.

Shares of Robinhood jumped more than 4% Friday morning after it announced it purchased more than $605 million in its own shares.

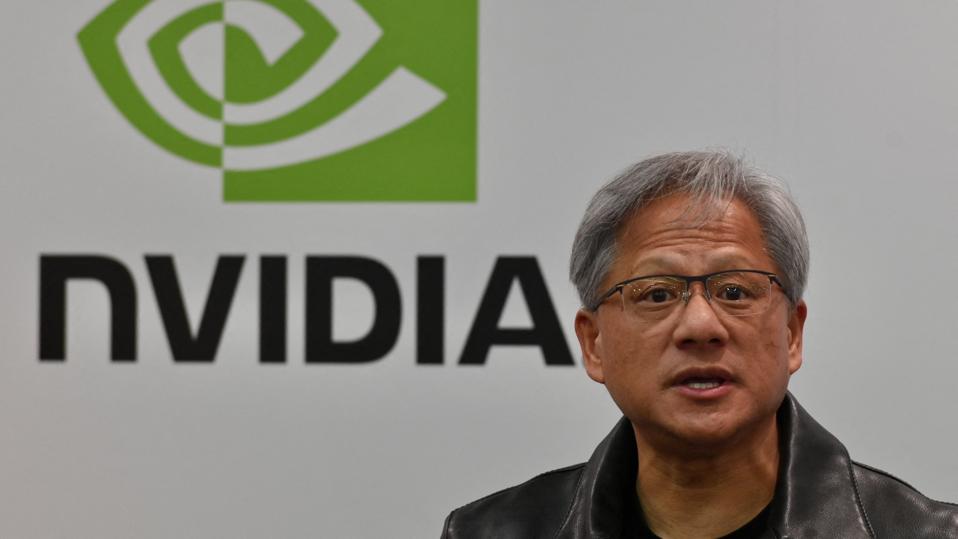

Getty Images

Key Takeaways

- Robinhood’s shares rose to a nearly one-month high, at just over $11.30 per share, after it said it closed on an agreement with the U.S. Marshal Service this week to buy nearly 55.3 million shares at $10.96 each.

- Those shares, which represent roughly 7% of Robinhood’s outstanding shares, had been purchased in May 2022 by Bankman-Fried’s Emergent Fidelity Technologies, though its stake in the company was short-lived, after being seized by the federal government earlier this year following the Department of Justice’s criminal indictment of the beleaguered head of the bankrupt cryptocurrency firm.

- Robinhood had been planning to buy the shares back for months, with its board authorizing the purchase in February, Robinhood CEO Jason Warnick said at the time, sending its shares up nearly 5%.

- The agreement closed Thursday, according to a Securities and Exchange Commission filing, which was also approved by the U.S. District Court in the Southern District of New York.

Key Background

Bankman-Fried, a one-time crypto billionaire whose sudden rise to stardom gained him international acclaim, was indicted in New York federal district court and charged on eight criminal counts in December, including on counts of wire fraud of customers and lenders, conspiracy to commit money laundering, conspiracy to commit securities fraud and conspiracy to commit wire fraud on lenders.

According to prosecutors, Bankman-Fried led a massive scheme to defraud FTX customers by misusing users’ deposits to pay off expenses of sister company, Alameda Research. Bankman-Fried, who was released on a $250,000 bond, pleaded not guilty to all eight counts, and in March pleaded not guilty to five additional federal charges, including a count of bribery for allegedly paying a Chinese official $40 million.

Surprising Fact

Last month, a judge in the case issued a gag order against Bankman-Fried, after prosecutors requested he be detained for allegedly leaking the personal information of his former girlfriend and business partner Caroline Ellison to the New York Times in a bid to discredit her as a witness in an upcoming fraud trial.

Prosecutors claimed the former FTX leader reached out to the press on multiple occasions.

Contra

Robinhood’s stock had been slumping in recent weeks after a federal judge ruled earlier this month a class-action lawsuit can proceed against the company, stemming from its decision in 2021 to bar users from trading in so-called meme stocks, including Bed Bath & Beyond, GameStop and AMC, after shares of those companies unexpectedly shot up, with GameStop’s stock skyrocketing as much as 1,700%.

This article was first published on forbes.com and all figures are in USD.