Robert Hale became a billionaire capitalising on the technology Alexander Graham Bell patented in 1876. But time’s up, and now the 21st century is calling.

“Good fun, good fun!” bellows Rob Hale on a recent Friday morning. It’s 6:30 a.m., and two dozen employees of Granite Telecommunications have gathered for one of their CEO’s favourite rituals: hourlong morning workouts, a gruelling grind of pushups, squats, burpees, sit-ups, planks, jumping jacks and stair runs through the company’s four-story office headquarters in Quincy, Massachusetts, a blue-collar burb 10 miles south of Boston.

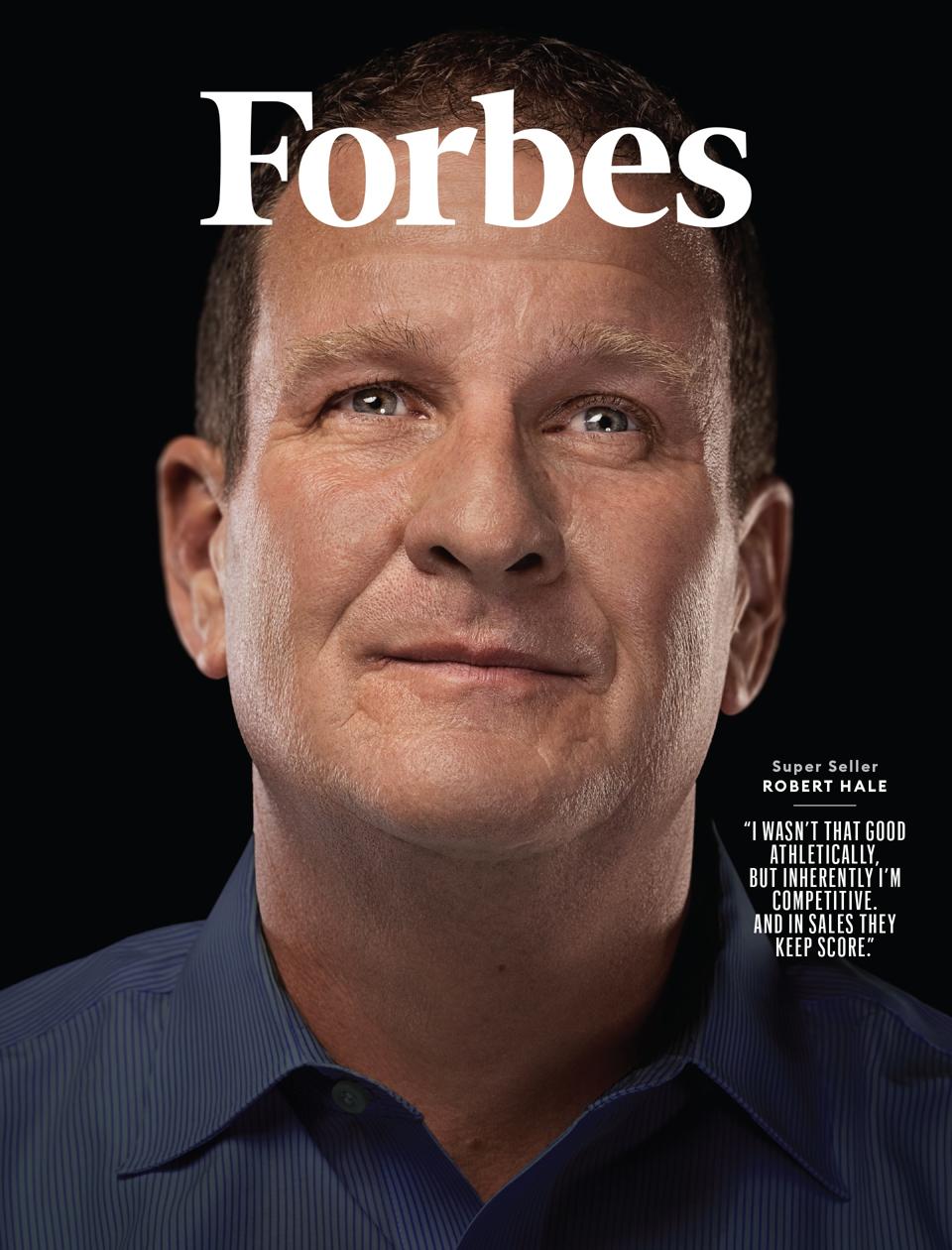

Photo by Michael Prince for Forbes

Hale, 56, likes routine. His typical workday includes nabbing the parking lot’s fifth spot (five is his lucky number), downing four extra-large decaf Dunkin’ coffees (two in the morning, two in the afternoon), overseeing a second group workout at noon (this one, mercifully, 20 minutes), then getting home in time for dinner with Karen, his wife of 28 years. “My life is very regimented,” Hale explains. “It doesn’t deviate much at all.”

Such discipline pays big dividends. Privately held Granite generated over $1.6 billion in sales last year and has no long-term debt. Twenty years after Hale’s first company collapsed, he boasts a $5 billion fortune from his estimated 70% stake in Granite and is one of America’s 400 wealthiest people for the second year running.

How did he do it? Forget about the blockchain, the metaverse or the cloud. The Bostonian built a 21st-century telecommunications empire on the back of 150-year-old technology: twisted-copper-wire telephone lines, or “plain old telephone service” (POTS, as it’s known in the industry). Granite, a telecom wholesaler, leases these old-fashioned lines from phone companies, then sells the service back to businesses at a premium.

POTS has one huge advantage over fiber-optic cables and wireless: unmatchable reliability. Unlike glass fiber, twisted copper can transmit electric power, meaning POTS keeps working even during a blackout. That makes it attractive for powering essentials such as fire alarms, security systems and emergency elevator phones. “Wall Street thinks they’re dead, but every retailer on the planet has a couple of POTS lines,” Hale says.

Granite’s angle is to sell POTS to national retailers (Nike, CVS and PepsiCo are clients) whose IT chiefs want a single point of contact for their many phone lines in many different states. When a POTS line in Montana goes down, techies at CVS don’t have to chase after the local phone carrier to fix it; they call Granite, which does it for them.

“Any national brand you can think of, they don’t want to deal with seven phone companies,” Hale explains. “They want to deal with one.”

That deceptively simple formula has worked for years. But now Granite faces an existential crisis: Hang up on landlines or get left behind.

HOW TO PLAY IT

By Jon D. Markman

Old telecommunication networks, characterized by copper line strung between wooden poles, are slowly disappearing. Arista Networks makes the equipment for what comes next: software-defined networks. These are robust, scalable networks that support innovative technologies like 5G wireless, digital streaming media, remote work and hyperscale cloud computing. Supplying these markets is a booming business, and lucrative. Arista reported in August that second-quarter revenue rose to $1.05 billion, up 48% year over year. The gross margin was 61.9%. Shares of the Santa Clara, California–based company could trade to $155 within 12 months, a gain of 24% from the current price of $124.75.

Jon D. Markman is president of Markman Capital Insight and editor of Fast Forward Investing.

There were only 32 million active POTS lines in the U.S. last year, compared to 123 million in 2010, according to the Federal Communications Commission. Copper lines are expensive to fix, and upkeep is difficult. For decades the government required phone companies either to maintain their POTS lines or resell them to competitors like Granite, but those mandates are winding down. AT&T, which along with Verizon is one of America’s largest POTS carriers, announced in March that it plans to deactivate half its copper lines by 2025. Many businesses have already moved their phone systems online—commonly known as “Voice over Internet Protocol” (VoIP). Companies still relying on POTS for fire alarms and other critical services are increasingly adopting battery-backed wireless systems known as POTS replacements.

Granite is feeling the heat. Annual sales from its POTS business declined last year for the first time ever. “With the way this market is looking, at some point POTS may not be around,” says Denise Munro, a consultant at CRG Telecom, which focuses on cost management.

That’s why Hale is expanding his wholesale playbook. Granite is still the middleman in these new markets. But rather than just POTS, the company now leases cable internet and buys wireless equipment in bulk, then manages it in exchange for a monthly fee. POTS lines now account for only half of Granite’s revenue, down from 100% a decade ago. Its cable and wireless VoIP products now account for 20% and 15% of sales, respectively. Last year, Granite made its first acquisition, shelling out $20 million for EPIK, a manufacturer of POTS replacement devices, which Granite is selling to customers that are quitting copper.

The further Granite strays from its lucrative landline niche, though, the more competition it faces. That includes large phone and cable companies (such as Verizon, AT&T, Charter and Comcast) that sell to Granite but also want to sell to businesses directly. There are more direct competitors as well, such as RingCentral and 8X8, both of which are based in the Bay Area and trade on the New York Stock Exchange.

The Vault

O.G. AMERICA ONLINE

A half-century before Rob Hale began selling phone lines to businesses, a then-108-year-old Western Union had transformed itself from a “onetime woebegone has-been” into a “top comer in the communications field” with its own plan to tap the corporate world for fast growth: its private wire business, which generated $42 million a year ($430 million today) handling internal communications for customers such as United Airlines, the Pennsylvania Railroad Company and the United States Air Force.

Resplendent in a silk shantung suit, Walter Peter Marshall, troubleshooting president of Western Union, stood beside Brigadier General Bernard Wootton at Hickam Air Force Base in Hawaii one day last month, a wide grin spreading over his highcheekboned face. Flicking a switch, General Wootton formally put into service the Air Force’s spanking new communications network, linking Hickam with Fuchu, Japan, and the U.S.’ 250-station, 250,000-mile high speed electronic private wire system, all of it designed, built and installed by Western Union. —Forbes, August 1, 1959

“Telecom can often be a very messy business, as companies who are cutthroat competitors can also end up partnering and relying on one another,” explains Rich Tehrani, a telecom investment banker at New Jersey–based Four Points Capital Partners, who adds that Granite has “literally thousands of competitors” across its business lines.

Hale says Granite’s operating margins for its cable and wireless segments are “about the same” as for phone lines (which Forbes pegs at between 15% and 20%). He also argues, perhaps predictably, that Granite’s POTS background gives it a leg up on the transition. For instance, cable companies’ networks, like those of phone carriers, are geographically constrained, which means Granite’s national aggregation model is still workable. Wireless networks also vary dramatically in quality depending on location.

Above all, customers will stick around because they like Granite’s customer service, insists Hale, who prides himself on regularly speaking with clients. “We are a customer machine,” he says. “People think it’s a transactional business. It’s not. It’s a relationship business.”

Hale’s vibe—fist bumps, small talk and self-deprecating jokes—is more back-slapping politico than aloof tycoon. He’s a big presence on New England’s philanthropy scene. He and Granite have collectively given over half a billion dollars to various hospitals, universities, schools and local charities. The company’s annual Saving by Shaving event, a cancer fundraiser for which attendees shave their head and donate the hair to make wigs for chemo patients, has become a Quincy fixture, drawing Boston sports legends including Tom Brady and David Ortiz. “There may be people [in Boston] who give more than Rob, but I would be surprised,” says Massachusetts Governor Charlie Baker, a close friend of Hale’s.

Born in 1966, Robert Hale Jr. grew up in Northampton, a town of 30,000 in western Massachusetts that’s home to Smith College. His father, Bob, was an entrepreneur who imported women’s clothing. Charismatic (class president at Connecticut College) but mediocre in school (“I was a C/B student, with an emphasis on the C”), Hale found his calling in sales, first at long-distance phone company MCI—where he started in 1988 after graduating with a B.A. in history—and then at New England Telephone, a local carrier (now owned by Verizon).

“When I got to sales, within a month I was like, ‘Wow, I’m good at this,’ ” he recalls. “I wasn’t that good academically, and I wasn’t that good athletically, but inherently I’m competitive. And in sales they keep score.”

In 1990, he started his first company, Network Plus, with a $400,000 loan from his parents (“that was their nest egg”) and an idea that foreshadowed Granite’s: wholesale buying and selling of cheap long-distance phone lines for small businesses. “From ’91 through ’98, we grew profitably,” he says with a sigh. “We had a great business.”

Then, he recalls, Wall Street came knocking: “Goldman Sachs cold-called me in ’98 and said, ‘Do you want to do a bond offering?’ I said, ‘I’m a phone guy, not a finance guy; I don’t know what that means.’ They said, ‘You can do a bond offering, do an IPO and you’ll be a billionaire.’ I was like, ‘Yeah, I definitely want to do that bond offering.’ ”

No wonder: It was near the peak of the dot-com bubble, and investors were throwing money at all things telecom. Hale hitched his wagon to the frenzy. Network Plus took on over $200 million in debt with plans to build a regional phone network. The company went public in June 1999. Fleetingly, Hale was indeed a billionaire.

Then it all came crashing down. As the telecom sector cratered, investors ran for the hills and lenders closed their spigots. For debt-strapped Network Plus, that meant declaring bankruptcy in February 2002. The company sold its remaining assets for less than $16 million and laid off hundreds of employees.

“Building a network is like building a bridge, and we were left with half a bridge,” says Hale, who was left devastated by the experience.

“I lost a ton of weight because I couldn’t eat. Every morning, I’d get up and throw up. I was wounded, emotionally wounded. I needed to reclaim my dignity.”

He threw his energy into Granite, which he started the same year Network Plus went belly-up. The company, by Hale’s own admission, got lucky. The original plan was to build another phone network, but that was too expensive, so instead Granite leased some phone lines in the Boston area. “It was just to get in the game,” he says. “We were gonna get some customers and build a little scale, then deploy switches, much like everyone had always done.”

But then Walmart and Walgreens separately contracted Granite to manage all their phone lines in the Boston area. The arrangement worked. Deals followed for Granite to aggregate their phone lines in New England, then across the Northeast—and, eventually, across the whole country.

“People always say, ‘How’d you get the great idea?’ We didn’t. They did,” Hale says. “We just had the common sense to listen.”

He’ll need to keep his ear to the ground as landlines become obsolete: If Granite’s next 20 years are to match its first 20, it will take a lot more than common sense.

This article was first published on forbes.com