Three key drivers of innovative health are the ageing population, innovation and the high cost of healthcare.

Great changes and advancements have been made in healthcare over the past decade and technology is playing an increasing role in improving patient outcomes. Medical devices have become less intrusive and more effective, treatment is becoming more targeted, and surgeries can be performed via robotic processes, significantly reducing human error.

Technology can allow people to access specialised care that they previously may not have been able to access, and it also enables greater accuracy in administering treatments.

Ultimately, all these technological advancements have the potential to provide excellent investment opportunities in the thematic called innovative health.

What is driving innovative health?

There are three key drivers of innovative health, and they are: the ageing population, innovation and the high cost of healthcare.

A global ageing population increases demand for healthcare services as the older you are, the more likely you are to experience ill health and need appropriate care.

Then there are those companies focusing on innovation and which are inventing new products to either cure or treat diseases.

And finally, healthcare in countries like the US can be incredibly expensive – it is estimated up to 20% of US GDP is spent on healthcare – and there are companies looking to drastically decrease the cost of healthcare for those that need it.

How do you find investment opportunities in innovative health?

The best opportunities can often be found in companies with products that are akin to the ‘picks or shovels’, meaning companies that have developed a product or piece of technology that has become crucial to a part of the healthcare market.

The investment in research and development that enables a company to become a critical supplier, ultimately gives the company a fantastic protective ring around its business, which can lead to a long-term growth.

Using Covid as an example, instead of investing in the companies that were working on the COVID vaccine, by investing in the companies that were supplying the equipment and consumables to make the vaccine, you didn’t need to pick a winner in terms of which company would develop a successful vaccine.

What are some examples?

Two examples of innovative health companies are Abbot Labs and Dexcom, both companies that have technology products that help treat the global diabetes market.

Diabetes is a disease that affects over 400 million people globally, and before the development of technological solutions, patients were forced to measure blood sugar content through invasive finger pricks.

Now, given the development of new technologies from Abbot Labs and Dexcom, patients can continuously monitor their blood sugar content without the need for finger pricks. The adaption of technology to this market has not only reduced the need for a finger pricking procedure but has also improved accuracy and data collection through continuous monitoring which helps lower the risk of hypoglycaemic events for the patient and so can reduce the risk of hospitalisation.

Companies that continue to invest in and develop technology that solves major medical problems, or which improves the quality of care for more patients, are likely to do well even when markets are unpredictable.

What is the long-term outlook for innovative health?

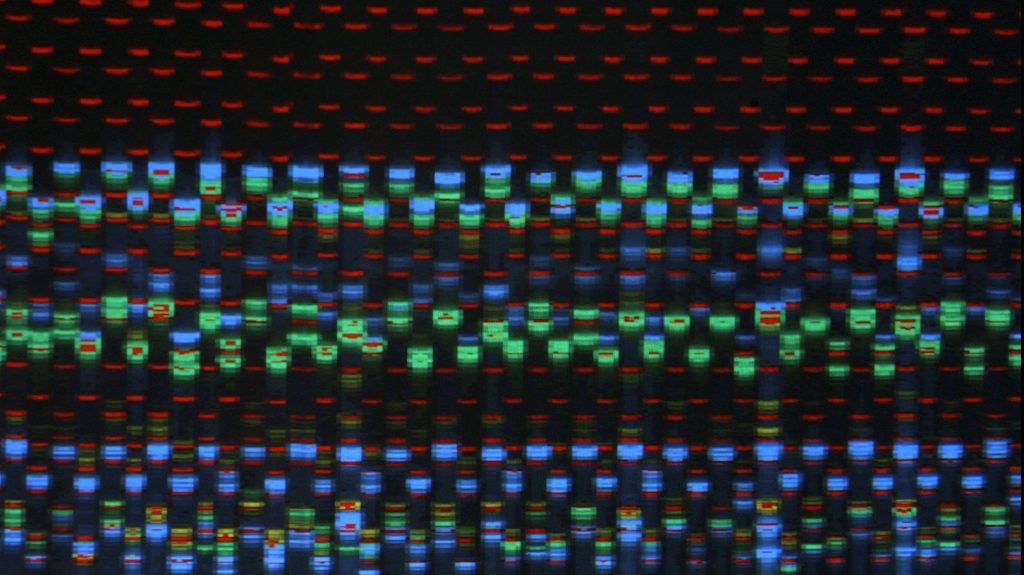

The long-term outlook for innovative health is most likely in the areas of cell and gene therapies and genomics. That’s where modern medicine is trending to. They may not be areas that are easy to identify today but they’re areas that investors will want to keep an eye out for in the future.

Kieran Moore joined Munro Partners in July 2016 and has focus on global growth equities since 2014 .

Disclaimer: The material contained in this publication has been furnished for general information purposes only as is not investment advice of any nature. The companies mentioned are for illustrative purposes only, is not a recommendation and may or may not be held by a Munro fund. There can be no guarantee that any projection, forecast or opinion in these materials will be realised. As an actively managed fund, Munro continually assesses each portfolio holding and the views expressed in this document may change at any time subsequent to the date of issue. This information has been prepared without taking into account the objectives, financial situation or needs of individuals. No representation or warranty is made concerning the accuracy of any data contained in this document.