Luxury goods companies are riding high on strong sales of exclusive brands sought after by cashed-up consumers.

Luxury-goods companies are riding high on strong sales of exclusive brands sought after by cashed-up consumers. It’s not uncommon on Sydney Castlereagh Street to see shoppers queuing outside exclusive boutiques to get the chance to buy a luxury item, many of them sold by luxury goods giant LVMH-Moet Vuitton, which hit a record high this month and became Europe’s most valuable company exceeding €400 billion.

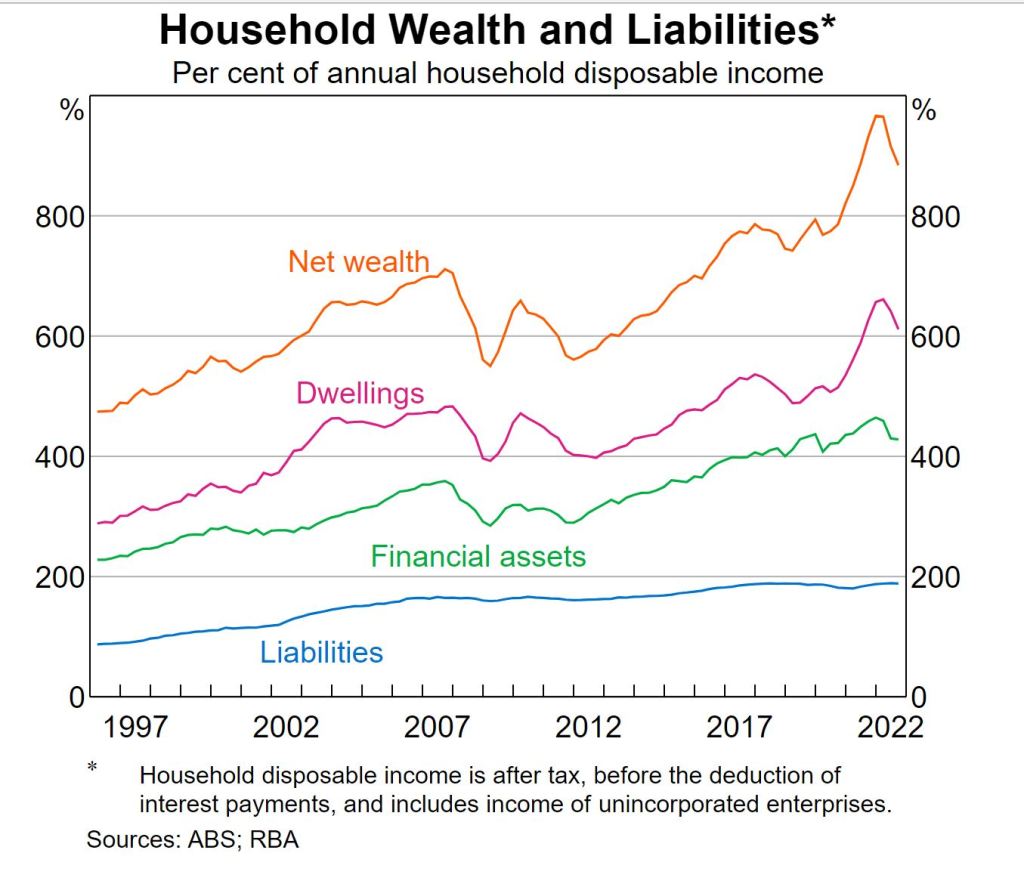

That company has been riding a wave of spending on luxury goods globally. In Australia, too, luxury spending is high. Two years of enforced savings and lockdowns have put wads of cash into Australians’ pockets, notwithstanding higher interest rates and mortgage repayments. According to estimates from the Reserve Bank of Australia, households saved around $260 billion during the pandemic, and they are still spending up, keen to enjoy the good life. Moreover, Australians enjoy high levels of wealth. The chart below illustrates the sharp rise in household wealth, which has far exceeded the increase in liabilities as a proportion of household income since 2019.

Recent data from the Australian Bureau of Statistics confirms the bullish nature of retail spending in Australia; retail turnover rose 1.4 per cent in November 2022 to a new record high of $35.9 billion.

That boom in sales, low unemployment, high wages and an expected increase in tourism from China could benefit Australian and global luxury goods producers. Morgans retail analyst Alex Mees says customers have responded to higher prices by buying fewer but more expensive items. “This may be good news for fuller-priced and luxury goods retailers like Cettire,” says Mees. Luxury items include jewellery, watches, handbags, luxury cars, clothing, leather goods, perfumes, and cosmetics.

“The CEO of the British fashion retailer Next plc (NXT LN) has said that said ‘if anything, people are shifting their preferences up the price architecture rather than down it’. If a similar dynamic is at play here in Australia, this may be good news for fuller-priced and luxury goods retailers like Cettire,” says Mees. Cettire is an Australian-owned, online luxury fashion retail platform selling clothing, shoes and accessories from over 1300 international high-end fashion brands, including Prada, Gucci and Dolce & Gabbana.

Other retailers of premium consumer products that could benefit from spending on luxury items include Treasury Wine Estates, which sells several upmarket wines, including the famous Penfolds Grange and healthcare company Blackmores, from vitamin sale and pet products.

“Treasury and Blackmores could also benefit from the reopening of China, which appears to be gathering pace,” says Mees.

A recent survey from investment bank UBS of around 1,000 Australian adults between 22 November and 8 December found higher income earners have surprisingly bullish spending intentions. “The survey pointed toward still strong positive sentiment from high-income earners, although they did step back somewhat versus euphoric third quarter results. High-income earners remain most optimistic on spending, income growth, savings, home purchases, home renovations, travel, and vehicle spending,” said a UBS Australian Equity Strategy report.

“[Companies] with a customer base skewed towards this group include ASG, Breville, Qantas, Scentre, Select Harvest and Treasury Wine Estates.”

But local listings of pure luxury stocks are limited, says Drew Meredith, partner and financial adviser with Wattle Partners. “Unfortunately, the ASX is a little light when it comes to consumer companies that are directly exposed to the recovery in spending on luxuries,” he says. But Meredith, too, cites Cettire as a beneficiary of robust spending on luxury items.

However, according to Meredith, high spending on luxury goods could taper off later this year. “The wealth effect from falling property and share market values will likely impact consumer spending at some point. That said, wealthier consumers have historically been more immune than those that pay a larger portion of their income on borrowing and non-discretionary items,” says Meredith.

“The ability of luxury items to maintain and carry their value will likely contribute to a smoother ride for spending on this sector, despite the impact of rates.”

For an investor seeking exposure to the world’s biggest luxury brands, investing in luxury-focused exchange-traded funds (ETFs) is one way to start. The Amundi IS S&P Global Luxury ETF tracks the S&P Global Luxury Index. That Index comprises 80 of the largest public companies producing or distributing luxury goods, including Swiss jewellery and watchmaker Compagnie Financiere Richemont, LVMH Moët Hennessy Louis Vuitton, Hermès International, Estee Lauder, Mercedes-Benz, Kering, Nike, Pernod-Ricard and Ferrari.

Or you could buy one of the stocks on their own. In terms of LVMH, Kering and Richemont, all three are well-diversified businesses owning high-profile luxury brands. While sales would be affected by a global economic slowdown, they own some of the world’s best-known and most enduring brands, which, as Meredith points out, will help to ensure they carry their value over time.

This article should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.