During Forbes’ interview with Sam Bankman-Fried on Monday he spoke about the extensive preparation he was doing to ready himself for today’s House Financial Services Committee hearings on the collapse of his crypto exchange FTX. You can read his full prepared testimony here.

On Monday afternoon Bankman-Fried was arrested by Bahamian authorities and is expected to be extradited to the United States. Forbes obtained a draft of the full testimony SBF was set to give before Congress.

Here are the key takeaways.

Bankman-Fried is being ghosted by FTX’s court-appointed CEO John Ray

“I have sent five emails to Mr. Ray. Mr. Ray has never responded, nor has he reached out to me to communicate in any other ways.”

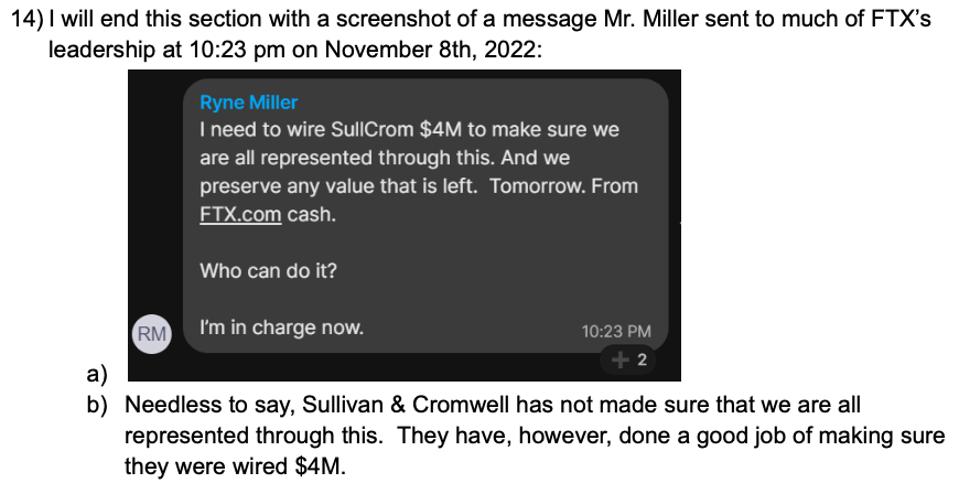

Bankman-Fried says that FTX.US general counsel and former Sullivan & Cromwell partner, Ryne Miller, put intense pressure on Bankman-Fried and others to rush into filing for Chapter 11.

“I have 19 pages of screenshots of Sullivan & Cromwell, Mr. Miller, and others I believe were influenced by them, all sent over a two day period, pressuring me to quickly file for Chapter 11. They range from adamant to mentally unbalanced. They also called many of my friends, coworkers, and family members, pressuring them to pressure me to file, some of whom were emotionally damaged by the pressure. Some of them came to me, crying.”

Bankman-Fried believes that John Ray and law firms managing the bankruptcy, including Sullivan and Cromwell, are dusting off the Enron playbook in an effort to reap enormous fees from FTX’s bankruptcy.

“In the Enron bankruptcy, law firms including Sullivan and Cromwell were paid roughly $700m (!!!) in fees from funds that would otherwise have gone to creditors.”

Bankman-Fried is blaming Ryne Miller for pressuring him to resign

SBF Draft testimony

The Chapter 11 team is not playing nice with foreign regulators.

“I have heard complaints that the Chapter 11 team is refusing to respond to regulatory inquiries from foreign regulators, sometimes at the risk of employees going to jail. I have also heard complaints of the Chapter 11 team freezing or otherwise interfering with funds duly belonging to various operating entities of FTX International.”

Bankman-Fried thinks that John Ray and the U.S. Bankruptcy Court is bullying the Bahamian government and overstepping its rights as the main domicile for FTX International.

“Their assumption, without evidence, of malign intent and incompetence on the part of other races, cultures, and governments would be considered deeply offensive if directed at American minorities. It is no less offensive when directed at the citizens of other countries, let alone their regulators. Meanwhile, seizing assets overseen by other governments is a practice most recently considered appropriate centuries ago.”

Bankman-Fried devotes seven pages to a section he calls “Misstatements,” detailing instances where John Ray and team are disseminating false and inaccurate information about the companies he created.

“I believe that United States regulators may have been told materially misleading information about FTX US, including claims that FTX US is not solvent. I believe that it is solvent.

FTX did not have a risk management team.

“While FTX International had a team dedicated to financials, and to many other areas of the business, it did not have a team dedicated to risk management, or to user position monitoring.”

Bankman-Fried claims that there are signed Letters of Intent (LOIs) from prospective investors that could recapitalize the exchange.

“As of today, I am still aware of billions of dollars of serious offers for financing, including signed LOIs: billions of dollars that could potentially make customers substantially whole. However, I believe that all of those are conditional on FTX being restarted as an exchange. I sincerely hope that all of the global teams working on FTX are seriously considering such a possibility, because I believe it would drive a large amount of value to customers and creditors.”

Binance CEO Changpeng Zhao orchestrated a negative public relations campaign to bring down FTX.

“That tweet followed what I believe to be a month of sustained negative PR onFTX largely being driven by Binance.”

Having eliminated FTX as its largest global competitor, Binance is now averaging approximately 70% of global cryptocurrency volume.

“There is much more to say about Binance, its role in the cryptocurrency ecosystem, and its relationship with FTX, but this is neither the place nor the time for it.”

Bankman-Fried wants to set the record straight on false reports of hard partying at FTX and on his own drug usage. He says he has never been drunk in his life, and has been on an antidepressant for the last decade.

“The last few months have been difficult enough for everyone that it feels unremarkable to me, in comparison, that I need to put on the official Congressional Record that I am, and for most of my adult life have been, sad.”