Elon Musk is dialling down his DOGE role that triggered protests and vandalism at Tesla stores. But its EV business needs a hit product and none is on the horizon. And the company’s booming battery business, a Q1 bright spot, will suffer from Trump’s tariffs.

This week, Tesla posted its worst quarterly results in four years. Sales were down 9%. Income plummeted 71%—hurt by a 20% drop in automotive revenues. And given tariffs and rocky market headaches, the company didn’t bother giving sales targets for the rest of the year.

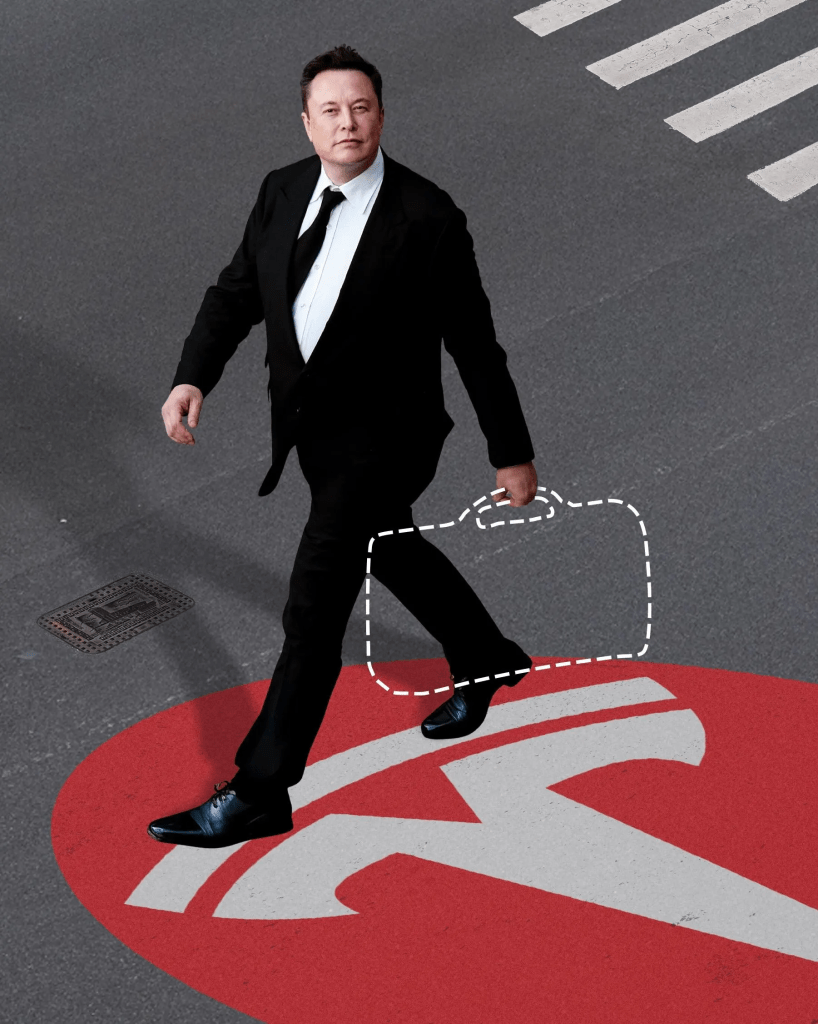

But the stock rallied, jumping 9% since Tuesday as investors cheered one thing: Elon Musk says he’ll soon step back from his duties gutting the federal government through DOGE, and return to running the show at Tesla in a more full-time capacity (excepting his other responsibilities at SpaceX, xAI and Neuralink).

That’s not the cure-all investors seem to think it is. The problems Tesla now faces have been exacerbated by Musk joining the Trump Administration as a “special government employee” — declining profit margins, intensifying competition and a tarnished brand image. And they show no signs of disappearing any time soon, even if Musk becomes a more active CEO again. Worse, it’s becoming clear Musk has run out of ideas for how to fix them, instead fixating on an uncertain future focused on robotaxis and humanoid robots.

For now, Tesla profits from selling cars and battery storage systems and both businesses are in trouble. It has no successor to monster sellers like the Model Y and Model 3 (Cybertruck, its latest release, has been one of the biggest flops in automotive history). At the same time, it’s about to get hit by President Trump’s tariffs, which are expected to chill auto sales across the industry. Worse for Tesla though, a coming 145% tariff on imported Chinese battery cells is set to hammer the company’s battery pack business, one of the only bright spots last quarter.

Musk downplayed these problems on the April 22 results call. “We’re not on the ragged edge of death, not even close,” he said. “There are some challenges, and I expect that … there will probably be some unexpected bumps this year.”

“This time, it’s not about the product. It’s about the person. It’s too late to separate man and brand. And in the meantime, it’s lost its EV advantage.”

Sue Benson, The Behaviours Agency

Some, though, are entirely expected. Though Musk’s political activities have been more time-consuming since Trump returned to office on Jan. 20–aided by $250 million from the world’s richest person–his embrace of rightwing politics and inflammatory social media comments have tarnished Tesla’s brand image for well over a year, particularly in important markets like California and Europe. Multiple polls, including one by Marquette University Law School this month, found that 60% of people surveyed had an unfavourable view of Musk and 58% disapproved of his DOGE work. A YouGov/Yahoo News survey last month found that 67% of Americans would not consider buying or leasing a Tesla, with most saying Musk was the reason.

“Remember VW’s emissions scandal? One regulatory crisis cost it tens of billions and its reputation. That’s where Tesla is now,” said Sue Benson, CEO and founder of The Behaviours Agency, a U.K.-based marketing firm. “Except this time, it’s not about the product. It’s about the person. It’s too late to separate man and brand. And in the meantime, it’s lost its EV advantage.”

Climate protesters spray paint anti-DOGE messages on a Tesla showroom in New York City.

Getty Images

And while Musk may be spending more time at the Austin-based auto company, he also still oversees SpaceX, X, the Boring Company and Neuralink (in addition to fathering his “legion” of more than a dozen children). Long before DOGE, his bandwidth was already limited.

“He said what he thought people wanted to hear,” said Ross Gerber, CEO of Gerber Kawasaki Wealth and Investment Management, who holds the company’s shares but has advocated for Musk to resign. “But he’s still going to go run xAI, he’s still going to keep doing what he’s doing at Tesla, SpaceX and X and still be involved with DOGE. What’s changed?”

“Just leaving these models in the market forever, with no significant sheet metal changes, means they are–to overstate things–zombies.”

Glenn Mercer, GM Automotive

The most pressing challenge for Tesla is reversing the decline in its EV sales, down 13% in the first quarter. More alarming is that automotive revenue dropped 20%, meaning it sold fewer vehicles and charged less for them. The entirety of its $409 million profit came from regulatory credits — free money it gets from other automakers to comply with pollution rules in the U.S., California and the EU. Without the $595 million in credits Tesla sold in the quarter––it would have posted a net loss.

The simplest, most obvious fix for ailing sales is a new model. Rather than doing that, however, Musk and his engineers are readying refreshed, and cheaper, versions of the Y and 3, which went on sale in 2020 and 2017, respectively. Rather than doing what traditional automakers call a “full” model change, where the body shape and interior are dramatically altered, the 2025 Model Y is more of a refresh of the 2024 version, with a new light bar running across the front hood and rear sections, sleeker headlights and more aerodynamic wheels.

That could provide a jolt to sales, but it’s not a winning long-term strategy. There’s a reason why car companies regularly release new models. Dramatic styling changes typically produce better results, according to industry researcher Glenn Mercer, who leads Cleveland-based advisory firm GM Automotive. “Just leaving these models in the market forever, with no significant sheet metal changes, means they are–to overstate things–zombies,” Mercer told Forbes.

Neither Musk nor Lars Moravy, Tesla’s head of vehicle engineering, shared details of how the company planned to offer the cheaper variants on the earnings call. Industry analysts expect Tesla to do this by using a smaller, cheaper battery pack with less driving range and eliminating tech features.

“If instead of restyling, Tesla just lowers prices by removing things–like they already removed ultrasonic parking sensors, for example–that’s even worse,” Mercer said. “Usually at this point in a decaying model’s lifecycle, you start adding stuff to divert people from seeing the ancient underlying appearance.”

EV Competition

You know who does have newer models? Fast-growing Chinese EV makers, particularly BYD, as well as domestic competitors like General Motors, Hyundai, Kia, Honda and Rivian. It’s no wonder Tesla’s share of EV sales has dropped to 43% in the first quarter, down from 75% three years earlier.

Until a few years ago, Musk claimed Tesla would sell 20 million EVs a year by the end of the 2020s. Now, he’s quietly dropped that goal, pivoting to a new business model built on selling robotaxi rides, AI services and worker robots.

“The future of the company is fundamentally based on large-scale autonomous cars and large-scale, large volume, vast numbers of autonomous humanoid robots,” Musk said this week. “So the value of a company that makes truly useful autonomous humanoid robots and autonomous useful vehicles at scale at low cost, which is what Tesla is going to do, is staggering.”

“It makes no sense. Cybercab should have just been a two-door, small $25,000 Tesla.”

Ross Gerber

That may be true, but Tesla hasn’t demonstrated it can do it. Waymo is the de facto leader in robotaxis, using vehicles equipped with far more elaborate sensors and computing capabilities than Musk plans. Meanwhile, Boston Dynamics for years has demonstrated humanoid and animal-style robots that appear to have far greater capabilities than Tesla’s wobbly Optimus. (One near-term problem: Musk said on the earnings call that Tesla can’t get rare-earth magnets the robot’s motors need right now owing to retaliatory restrictions that China, the sole supplier, implemented in response to Trump’s tariffs.)

Investors like Gerber want to see Musk prioritize new products instead. He thinks the Cybercab concept that Tesla showed off last fall, which Musk pitched as a futuristic robotaxi model with no steering wheel, could instead have been sold as a lower-priced EV.

“It makes no sense. Cybercab should have just been a two-door, small $25,000 Tesla,” he said. “Just do the Cybercab with a steering wheel and scale it up. It’s a cool-looking car and looks different than any other in its lineup and could attract new customers, especially if it’s $25.000. Doing a stripped-down Model Y is kicking themselves in the kneecap.”

Tariff Impact

Tesla is somewhat better insulated against Trump’s tariffs as it doesn’t import vehicles built abroad, or even from Canada and Mexico as most other automakers do. But it still sources steel, aluminum and auto parts from outside the U.S. so will be hurt by higher costs for those products. And tariffs will especially hurt its most successful business beside EVs: energy generation and storage, where it sells battery packs to homeowners, utilities and companies. In Q1, Tesla posted a 67% jump in this business line’s revenue to $2.73 billion.

Tesla Megapacks at the company’s Shanghai Gigafactory.

Xinhua News Agency via Getty Images

But for these battery packs, Tesla relies on lithium-iron-phosphate (LFP) battery cells made in China, which will now get stung by Trump’s 145% tax on imported Chinese goods. Tesla had planned to begin making LFP cells this year at its battery gigafactory in Nevada under a new licensing agreement with China’s CATL, the world’s biggest maker of EV batteries. They would be cheaper than the lithium-ion cells that go into Tesla’s EV packs. But that plan has now stalled.

“The impact of tariffs on the energy business will be outsized since we source LFP battery cells from China,” Tesla CFO Vaibhav Taneja said on the call. “We’re in the process of commissioning equipment for the local manufacturing of LFP battery cells in the U.S. However, the equipment which we have can only service a fraction of our total installed capacity of late.”

That means much higher prices for Tesla’s Megapacks and less business, especially from utilities buying them to store solar- and wind-generated electricity.

“Nobody, not even Tesla, makes LFP in the U.S. The 145% tariffs mean prices for those cells go up for everybody,” said a person familiar with Tesla’s battery operations who declined to be identified for fear of reprisal. “The utilities are just not willing to pay that higher price. It’s not like Tesla will lose out to competition. In this case, the market just disappears as the price goes up.”

Gerber, a long-time Musk fan who’s become an outspoken critic, sees no sign that Elon has any ideas to fix Tesla’s near-term product strategy, even if he’s doing less DOGE work.

“I just don’t see this as any big change for the better at Tesla,” he said. “It’s not going to solve their problems.”