Nvidia disclosed its first financial results of the year Wednesday, delivering an eagerly awaited earnings report providing early indications of how it will emerge from the release of the less tech-intensive DeepSeek AI model from China, which led to the AI giant suffering the largest single-day market value loss in stock market history last month.

Key Facts

- In its fourth fiscal quarter ending last month, Nvidia reported $39.3 billion in revenue, $0.89 adjusted earnings per share and $22.1 billion of net income, equating to year-over-year revenue growth of 78% and profit growth of 71%.

- Consensus analyst estimates called for Nvidia to report $38.1 billion in revenue and $0.85 adjusted earnings per share ($19.6 billion net income), according to FactSet data.

- Nvidia’s datacenter unit, which encompasses the company’s graphics processing units (GPUs) powering most generative AI models, brought in $35.6 billion in sales, smashing forecasts of $33.5 billion.

- The company said it expects revenue for its spring quarter to come in at $43 billion, give or take 2%, compared to Wall Street estimates of $42.7 billion.

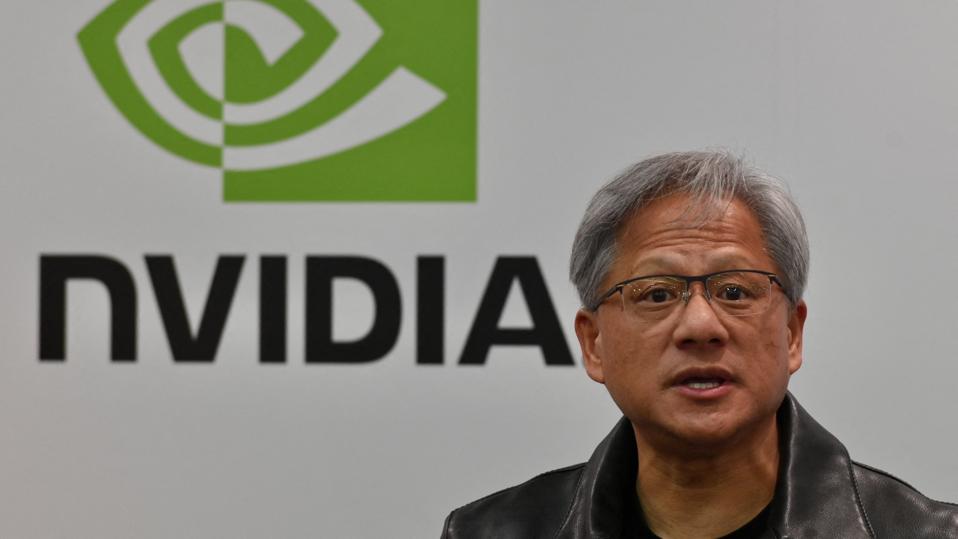

- In the earnings release, Nvidia CEO Jensen Huang called demand “amazing” for his company’s Blackwell GPU system which hit the market late last year.

- Despite the company’s across-the-board beats, Nvidia stock traded slightly lower in after-hours, with the slightly negative investor reaction potentiallystemming from the slight decline in the company’s gross profit margins, which chief financial officer Colette Kress attributed to “a transition to more complex and higher cost systems” in the datacenter division.

Tangent

This was the weakest top and bottom line growth for Nvidia since the quarter that ended April 2023. It’s still extremely robust expansion for a company of Nvidia’s size despite the slowing pace, as Nvidia’s growth dwarfs the 4% revenue and 10% profit expansion most recently reported by Apple, the only company with a higher market value than Nvidia.

Big Number

$72.9 billion. That’s how much net profit Nvidia brought in during its fiscal year ending last month, a 145% year-over-year jump. It’s an even starker 875% bottom line increase from the fiscal year ending in January 2023, as Nvidia took off amid the AI rush.

Nvidia Stock Wavered Ahead Of Earnings

Shares of Nvidia rose nearly 4% during normal trading Wednesday, closing at $131.28. But Nvidia, with a $3.2 trillion market cap, registered its cheapest intraday share price since Feb. 3 on Tuesday after a down start to the week, declining about 3% apiece Monday and Tuesday. This week’s losses come as tech stocks broadly pulled back amid growing investor anxiety about uncertainty from President Donald Trump’s economic agenda; the Nasdaq declined more than 1% each of Monday and Tuesday as the index closed at its lowest level since late November. Nvidia stock entered earnings while navigating an unusually down stretch, trading about 10% below where it stood ahead of its most recent earnings report in November even after Wednesday’s bump. And the stock is down nearly 10% over the last month during the DeepSeek selloff, as the market expressed concerns high-performing generative AI models which can run on less of Nvidia’s pricey semiconductor technology may lead to weaker sales for Nvidia. The earnings report was a “massive” test for a wobbling stock market with perception “heavily skewed negative right now,” remarked Wedbush analysts led by Dan Ives in a Tuesday note.

Contra

Heading into earnings, analysts remained largely optimistic on Nvidia stock despite the recent holding pattern. The $175 average price target among the 68 analysts tracked by FactSet indicates 38% upside from Nvidia’s Tuesday share price. Wednesday’s earnings call “could mark the trough in investor sentiment,” predicted Bank of America analysts led by Vivek Arya, who are among the most outspoken Nvidia bulls on Wall Street with a $190 price target.

Key Background

The California-based Nvidia became the poster child of this decade’s AI revolution as the top designer of the technology training large-language models. Morgan Stanley analysts estimate Nvidia will capture about 95% of the $158 billion global GPU market in 2025. Nvidia’s dominant market share led to its stock to take off, and it was the best–performing stock of 2023 and 2024 among stocks listed on the S&P for the entirety of those years. But Nvidia has not outperformed the broader market recently, gaining 3.7% over the last six months, worse than the benchmark S&P 500’s 6.7% return. Huang, the 13th-richest person in the world, downplayed the negative investor reaction to the DeepSeek release, saying last week the idea AI spending will slow down is “complete opposite” of the truth.

This story was originally published on forbes.com and all figures are in USD.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.