Founded in 2021, PropHero manages more than $1.2 billion in real estate assets between Australia, Spain, Ireland and the Indonesian property markets, and serves 8,000 users in 40 countries.

OpenAI’s ChatGPT burst into public awareness more than two years ago. While many founders have jumped on the generative AI bandwagon since, French-born Australian startup founder Mickael Roger was deeply immersed in AI-powered commodity price forecasting as far back as 2017.

Today, Roger is the CEO of Sydney-headquartered startup PropHero, which this week closed a $25 million series A round.

Founded in 2021, PropHero manages more than $1.2 billion in real estate assets between Australia, Spain, Ireland and the Indonesian property markets, and serves 8,000 users in 40 countries, according to the company.

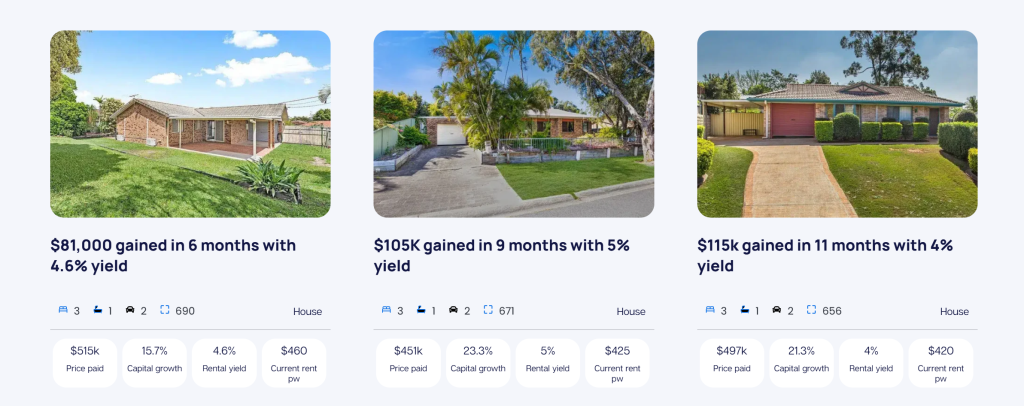

At the heart of the platform’s offering is AI-driven technology that “analyses millions of data points to pinpoint areas with the highest growth potential for investors.” The company states it helps clients buy the top 1% of investment properties that are on offer, and is using the fundraise to further develop the product offering.

“This raise will help us deliver our vision of offering everyone a real estate wealth advisor in their pocket, powered by Generative AI,” says Roger.

Four years after being founded by the former McKinsey partner, PropHero has reached annual revenue of $37 million.

“Since PropHero is already profitable, we are not raising this round to survive, but instead to grow even faster and continue building the world’s first GenAI real estate wealth management platform,” Roger says.

Roger’s PropHero co-founder Pablo Gil Brusola describes the service the company provides as a “one-stop-shop global property wealth management marketplace that helps customers build and manage their property portfolio in a simple, transparent, and profitable way.”

It does so by connecting property investors with property investment opportunities and uses AI to analyse the viability of the investment.

“Our ambition is to double revenue this year to US$50m while remaining profitable,” says Brusola. “PropHero’s success stems from our commitment to transparency and trust in property investment, with all data available to clients through our app.”

The $25.1 million raise was led by ASX-traded IT investment firm Bailador Technology Investments.

“Property is a huge global asset class that has been underserved by digital transaction solutions,” says David Kirk, Bailador’s managing partner.

“PropHero provides a world-leading solution for investors, demonstrated by very high growth, word-of-mouth customer acquisition, and a high proportion of customers returning to purchase multiple properties. Bailador is backing Mickael, Pablo, and the wider PropHero team to continue executing on their growth in Australia and internationally,” says Kirk, who will join PropHero’s board as part of the investment.

AfterWork Ventures, Fifth Wall, Jelix Ventures, Samaipata, Opera Tech Ventures, also contributed to the series A raise. Suvidh Arora, the CEO of the Australian operation, notes that the round was oversubscribed.

“Our mission is to make property investment more accessible, with a particular focus on millennials who are navigating a challenging housing market and seeking smarter, data-driven solutions to build their wealth,” says Arora.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.