Even if Donald Trump did end the Ukraine war, like he promised to do within 24 hours of entering the White House, DroneShield would be unaffected, says its Sydney-based CEO.

DroneShield CEO Oleg Vornik gets why his company is seen as a meme stock. Its share price soared in 2024, increasing 10-fold on the ASX from July 2023 to July 2024, but came down like it was caught in the sights of one of his own DroneGuns over the next six months.

He offers up a string of new contracts and a $1.1-billion pipeline of sales leads to contend that the company is once more undervalued. Though DroneShield has attracted shortseller interest since September and was sold down after US President Donald Trump’s November election win – with fears sales would be hit if he fulfilled his promise to end the Ukraine war “within 24 hours” of taking office – the new administration’s penchant for building walls promises to be good for business, Vornik says.

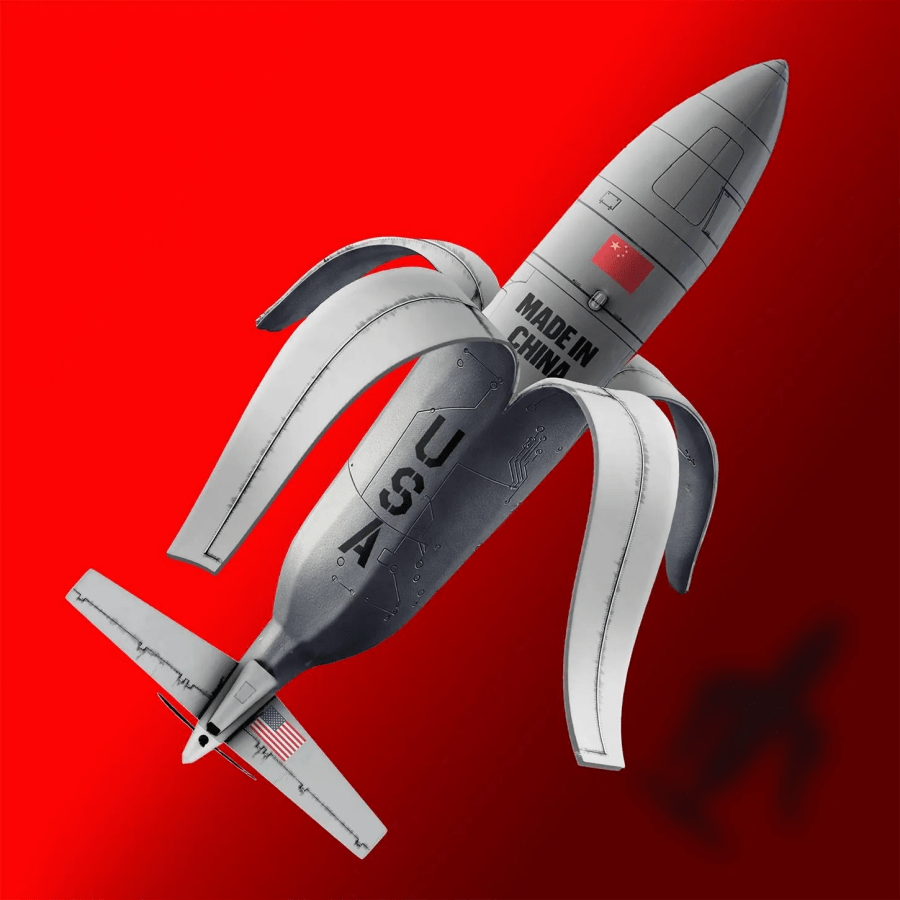

Ukraine is “nowhere near a meaningful chunk of our revenue,” Vornik says. “So, regardless where the war ends up, I’d say our biggest drivers now are Asia-Pacific where you have this everybody-versus-China sort of mentality. For example, in April last year a Chinese drone landed on the deck of a Japanese aircraft carrier … That type of situation really galvanizes the whole region.”

The US-founded but now Sydney-based, ASX-listed Droneshield makes a variety of equipment that protects against airborne drone intrusions, including gun-like weapons that disable them with electronic jamming.

“We naturally lend ourselves to being a meme stock because we’re a drone gun company,” Vornik says. “It’s like eye candy. It’s very easy for people to have emotional attachment to the business. It’s visceral by nature.”

The company raised $235 million in capital while its shares were on the up in 2024, buying it plenty of room for expansion.

Even when the share price peaked at $2.72 last July, giving Droneshield a market capitalisation of $2 billion, Vornik thought it was a fair valuation. “I was comfortable with where it got to … but not how quickly it got there. We went from about I think 70 or 80 cents up to close to $2.60 in the space of maybe a month and a half, which you clearly knew was unsustainable.

“I had individual shareholders writing to me along the lines of ‘I sold three houses to buy Droneshield shares. What do you think I should do?’ And the answer is kind of like, ‘Well, get a financial advisor.’”

DroneShield CEO Oleg Vornik

When Vornik told his Russian immigrant success story to Forbes Australia in 2023, the share price was dragging along under 30c. He complained then that the market did not understand DroneShield. And nothing has changed, he says.

“It’s been fascinating in that for a long time the business was well ahead of where the share price was, and it was very frustrating to watch the share price at 30 cents when you feel it should be much higher. Then we became flavour of the day in the middle of ’24. I remember where Stake, the online broker, had us number-one traded stock ahead of Tesla for a period of time.

“There were a lot of people in the stock who did not really understand the company and they got in simply because it was the flavour of the day.

“A lot of people probably moved on to the next shiny thing because they were invested not so much because they like the thematics of the stock, but basically because it was a hot stock.”

So, does the current price [around 68c when he spoke to Forbes Australia] represent a more realistic valuation with market capitalisation at almost $600 million?

“I’m naturally biased,” Vornik says. “I’d like to think we are significantly below where we should be. We’re currently trading on about 10 times revenue of 2023, which is our last publicly stated revenue. That’s not outrageous for a growth stock like ours – high IP, high technology sort of business.

“Ultimately it’s up to us to demonstrate revenue uptick that supports the significantly higher valuation that we would like.”

Bell Potter kept DroneShield as a “buy” recommendation in October when the price was sitting at 93c, putting a 12-month target of $1.20 on it, but the share price continued to fall after the US election and was just starting to rise again, when short sellers got in on the act.

Shortman published numbers this month showing that since September the percentage of DroneShield stock held by short sellers had grown from virtually nothing to 6.7%, meaning that people are betting the stock will fall further.

Vornik says he doesn’t know who the short sellers are, but that they’re taking a big risk, given the claimed $1.1 billion sales pipeline. “It’s a very dangerous game for the shorts because we get contract confirmations overnight, because most of our work is outside of Australia, so US, Europe, and so on. We have the obligation to release it to the market as soon as the purchase order is received.”

Vornik, who comes from a banking background, wonders if the short sellers appreciate that they can’t “put a stop order” on their position. “If we close the day at a particular price and then we do a massive contract announcement pre-open, because we receive it overnight, the price is just going to gap up. So, you will not be able to get out of your stock loss, you’ll get out at whatever price the stock opens at.

“I mean, obviously people are betting that the business is not in as strong a shape as it is, but we also have over $200 million in the bank, so I really can’t comprehend what is their rationale.”

He says that to date, the company has converted its pipeline to actual sales at a rate of about one in four. “If you apply the same logic, you get about a quarter of a billion in revenue this year, assuming it’s the same conversion rate as we had in 2023.”

And while Ukraine does not comprise a large part of DroneShield business, it has nevertheless been very good for business. [Australian companies are forbidden to sell defence equipment to Israel.] It’s taken the better part of three years for military and civilian procurement to catch up to the lessons of the war, he says. “We don’t do guidance, but in terms of our ability as a business, in terms of just counter-drone interest globally, I think we’re sitting on a significant wave here.

“The US, historically, has been majority of our revenues. But if you see our recent contracts, we had an $8 million European contract in December, a close-to-$10 million contract in Latin America [for anti-drug operations on the border of an unnamed country] where we hired a guy who’s ex-SpaceX to run our business based in Mexico.”

The market is continuing to evolve because the threats keep upgrading, he says.

“What has happened during the [Ukraine] war is that now we’re seeing not just the Russian government, but even the Chinese putting what would have been highly classified electronic-warfare techniques even five years ago into $10,000 drones. So essentially subsidising and pooling those complex military techniques into cheap drones designed to avoid, best they can, detection and defeat.

“What it means is, as a business, we’re not really competing with other counter-drone manufacturers anymore. We believe that our technology is significantly superior. But we’re competing against the likes of the Russian, Chinese and Iranian governments because they’re racing to add these kind of evasion techniques into the drones to stop systems like ours.”

Oleg Vornik

“The good thing is we are very well resourced. We raised quarter of a billion dollars last year across two capital raisings. The first one was towards ensuring we have enough inventory for quick sales. We’re now over 200 million bucks of inventory by sale value. You may say well that’s a lot of money but if you remember how expensive our devices are, it’s actually not that many in terms of units.” While declining to specify prices, he had pointed at a base station worth “north of” $350,000, and hand-held units worth “tens of thousands”.

The second raise was to employ more engineers, a process that’s ongoing. He says they’ve been going at ten hires a month and plan to keep going at that rate till their current engineering roster of 160 is up around 220.

Bell Potter forecast 2024 revenue of a $65.8 million in 2024, rising to $103.8 million in 2025 and $136.6 million in 2026. And while profit has been elusive to date, Bell Potter predicted an EBITDA of $22.3 million in 2025 rising to $41.1 million in 2026, counting on that pipeline coming to fruition

The Australian Defence Force is also tendering for a program called Land 156, to roll out counter-drone systems across all its bases. “We are now going through the tendering process for that and we believe we are well placed as the predominant Australian counter-drone manufacturer. We think this would be in the order of magnitude of a few hundred million dollars over the next five years alone.”

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent Financial and tax advice before making any decision based on this information, the views or information expressed in this article.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.