Australia pours billions into innovation, but its big spending yields average returns. Data journalist Juliette O’Brien investigates the country’s innovation paradox.

This story featured in Issue 14 of Forbes Australia. Tap here to secure your copy.

Australians like to think they punch above their weight. However, when it comes to innovation, the data shows the country underperforms.

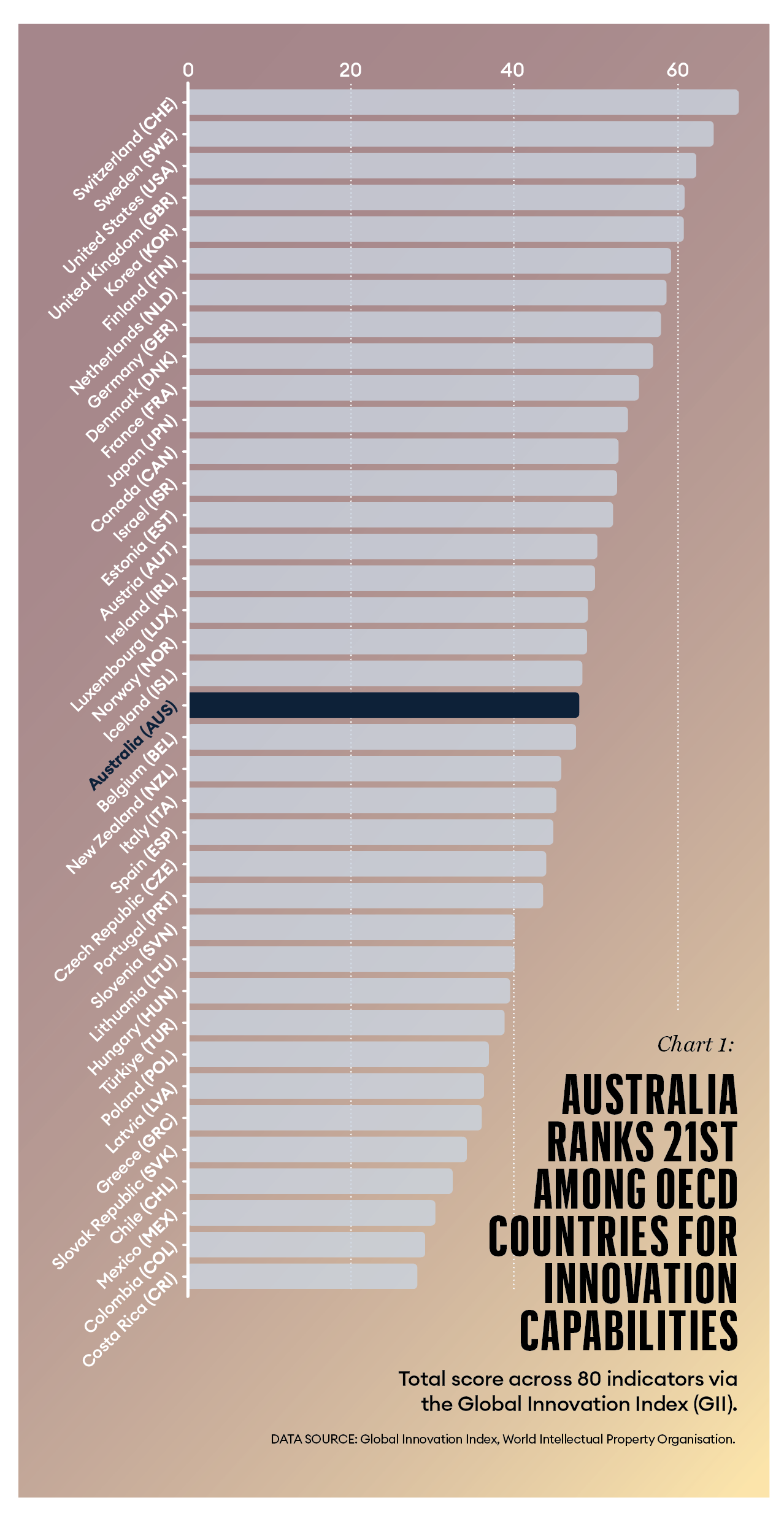

The Global Innovation Index (GII) ranks Australia at number 21 for innovative capabilities among OECD countries. (Chart 1).

That sounds great — except Australia is the OECD’s 11th-largest economy.

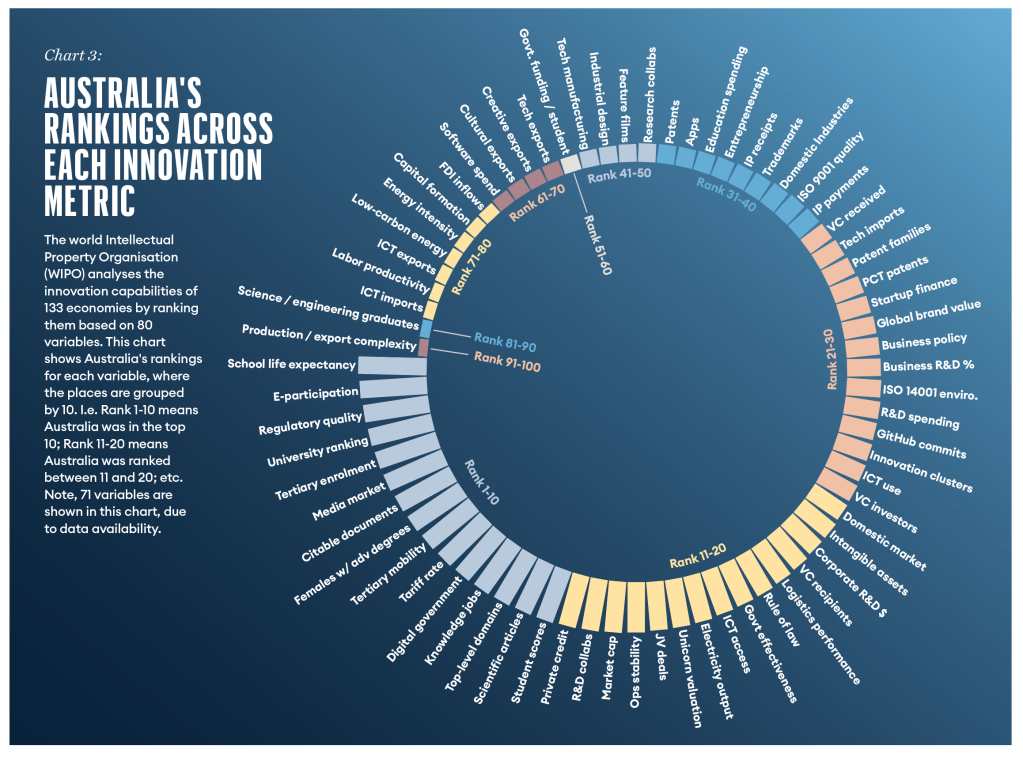

The annual index by the United Nations World Intellectual Property Organisation (WIPO) scores 133 economies across 80 indicators.

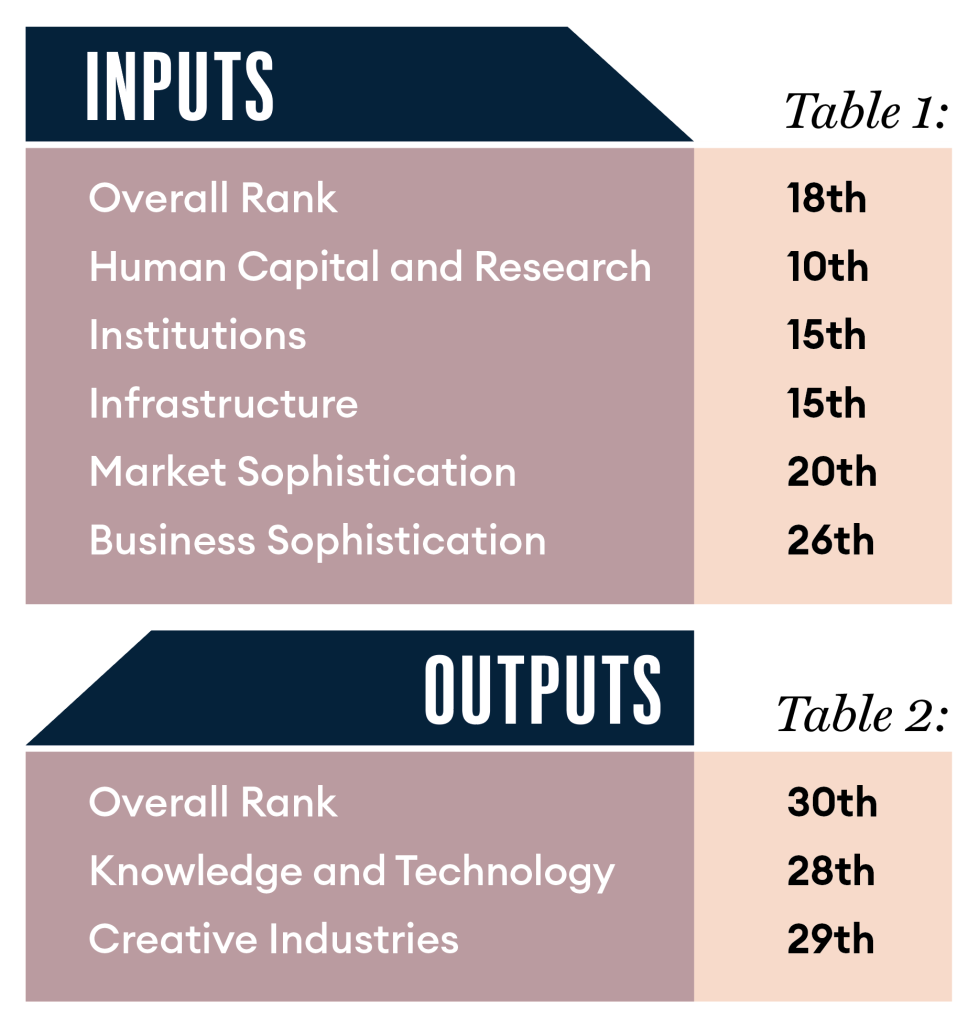

It examines “input” factors that fuel innovation (such as investments in human capital, institutions and infrastructure) and “output” factors, which are the measurable results of investments (such as knowledge, technology and creative exports).

Together, innovation inputs and outputs measure a country’s ability to transform investment into impact efficiently.

Regarding inputs, Australia ranks 18th overall, making it one of the world’s top spenders on innovation. This is based on scores across 55 variables that fall into five broad input categories (Table 1).

Yet these high investments produce modest results. Australia ranks only 30th for innovation outputs, based on scores across 25 variables that fall into two broad categories (Table 2).

That means Australia’s spending is not translating into top-tier outcomes.

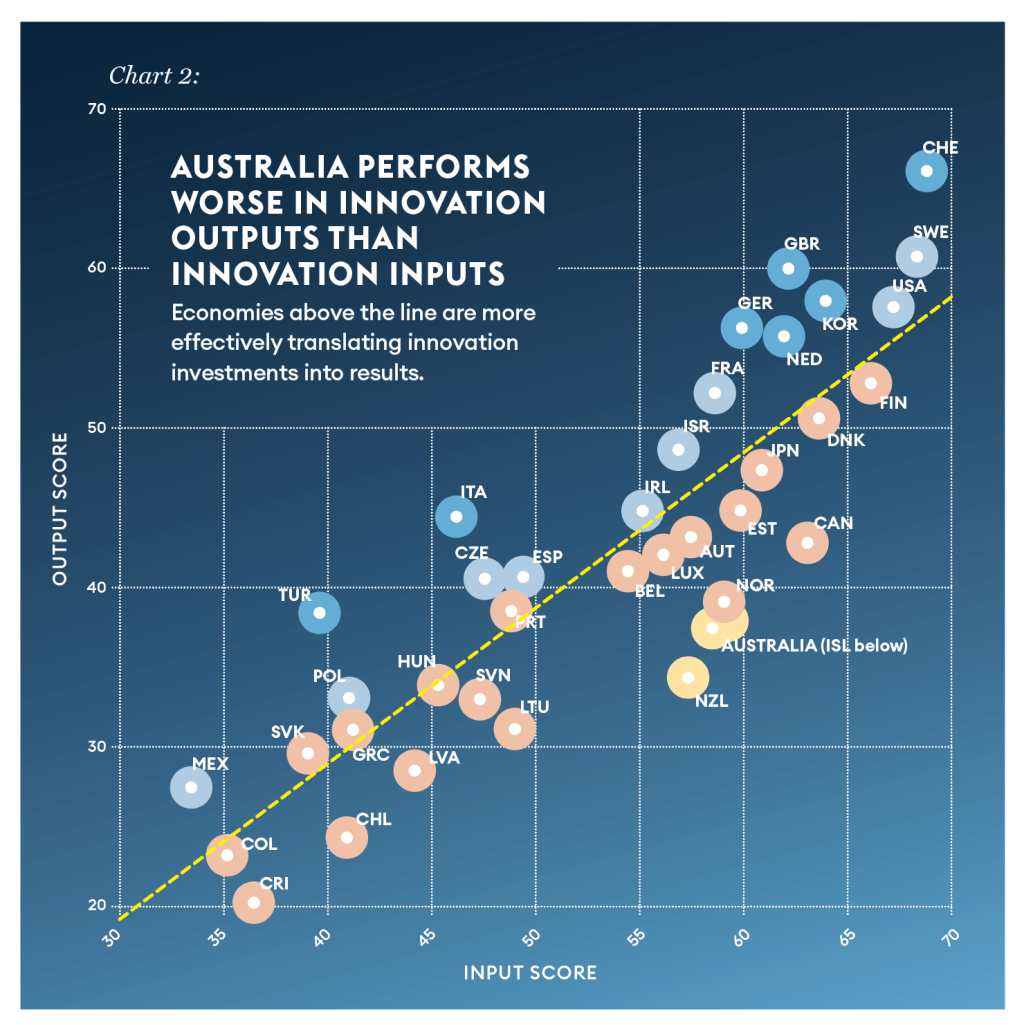

Top-performing countries like Switzerland and the United States generate more innovation results relative to investment. (Chart 2).

If we dig into the metrics that feed the rankings, Australia’s biggest strength is school life expectancy, where it ranks number 1 globally. (Chart 3).

It also gets high marks for university rankings (Chart 4), digital governance and regulatory quality. These set the stage for innovation.

The country’s weaknesses tend to fall on the output side.

The biggest disadvantage is production and export complexity, where it ranks 91st globally. (Chart 5). This is a symptom of the country’s huge reliance on raw exports.

It ranks 78th in labour productivity growth and 78th and 77th in ICT services imports and exports, respectively (both as a percentage of total trade). Cultural and creative exports fare little better at 67th, pointing to untapped potential in the creative industries.

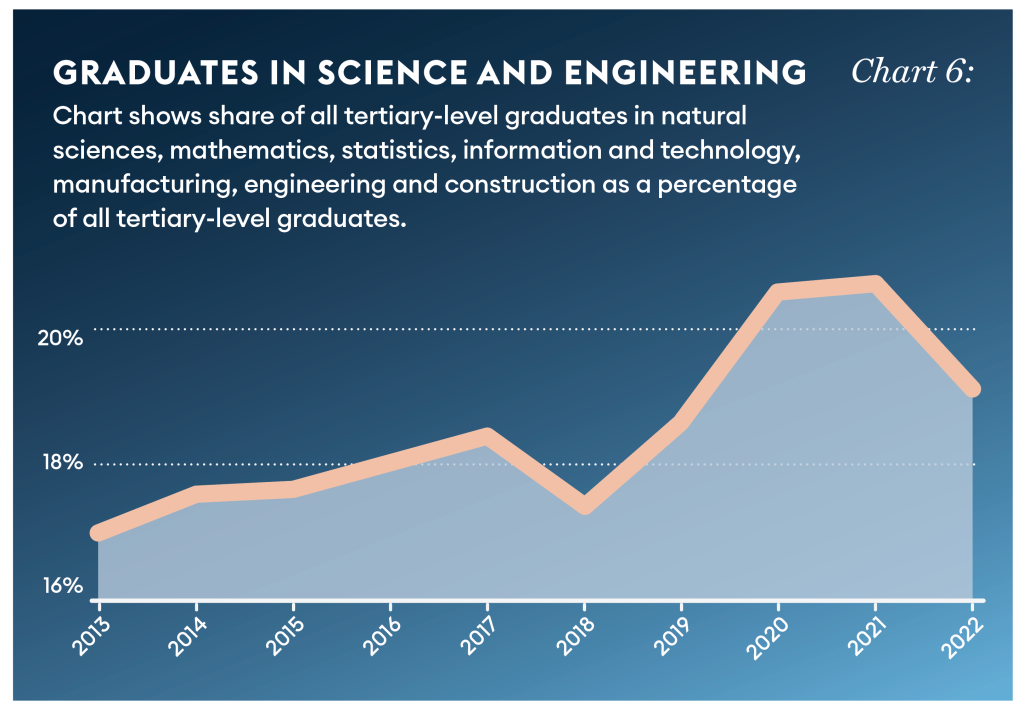

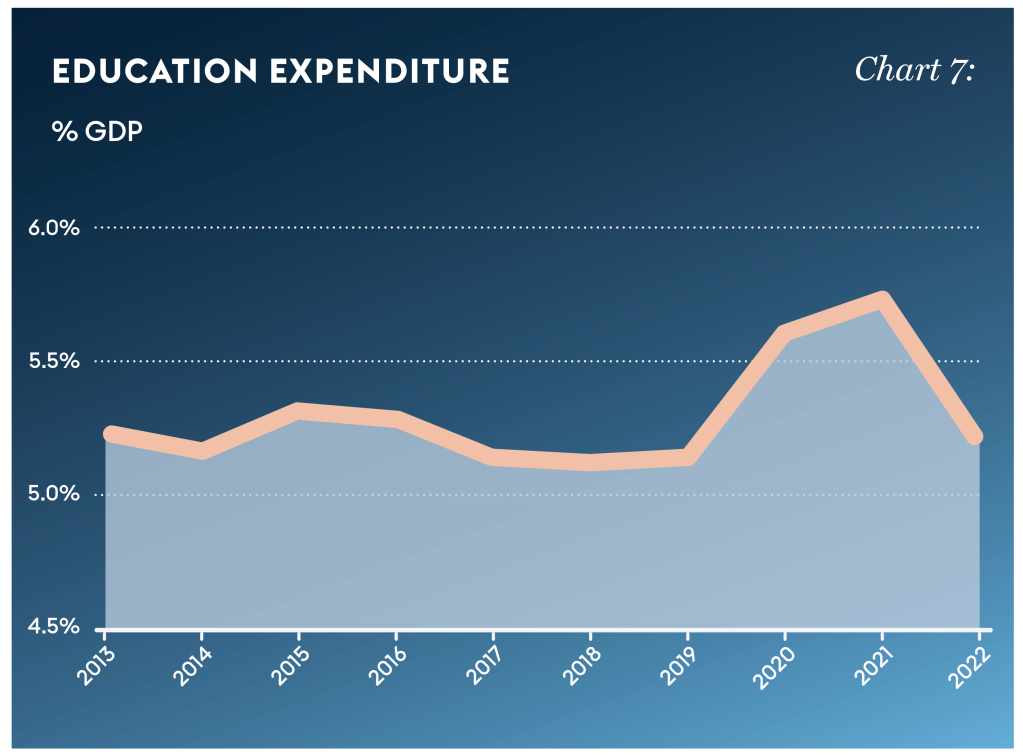

There are exceptions. On the input side, Australia struggles to produce science and engineering graduates (84th) and is wanting on education expenditure (37th), especially government funding per secondary student (55th). (Charts 6, 7).

Meanwhile, the nation excels in academic outputs, ranking 6th in citable documents and 10th in scientific and technical articles.

Three Australian science and technology clusters made the GII’s global top 100: a Sydney medical tech hub (led by Cochlear, ResMed, NewSouth Innovations), a Melbourne pharmaceutical cluster (Monash University, Oppo, University of Melbourne), and Brisbane’s civil engineering hub (University of Queensland and Griffith University).

The Australian government will invest $14.4 billion in R&D this financial year – a 4.7% increase from last year.

The GII report says that while increased spending and supportive policies are welcome, the country needs to get better at translating these investments into tangible results.

Substantial funding, solid infrastructure, and world-class research make Australia a smart country. It would be even smarter if it could translate these into bigger returns.