Nvidia’s hotly anticipated earnings report exceeded consensus expectations, as the world’s biggest company continued its streak of delivering explosive financial growth as the clearest beneficiary of the artificial intelligence gold rush.

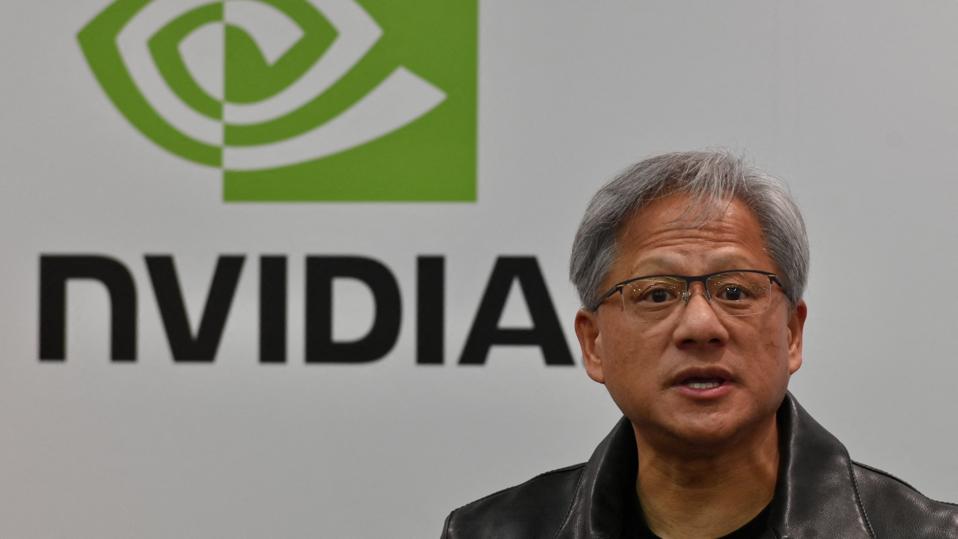

Nvidia’s centibillionaire CEO Jensen Huang speaks at a 2023 conference.

AFP via Getty Images

Key Takeaways

- Nvidia reported $0.81 adjusted earnings per share, or $19.3 billion net income, in the three-month period ending last month, topping average analyst projections of $0.75 EPS, or $17.4 billion net income, according to FactSet.

- The semiconductor chip architect generated $35.1 billion in sales, crushing estimates of $33.2 billion.

- Nvidia indicated growth will continue in the fourth quarter, guiding for about $37.5 billion in revenue, compared to consensus forecasts of $37.09 billion.

What To Watch For

How Nvidia’s results impact the broader market this week. Bank of America strategists wrote earlier this week Nvidia earnings “can dictate the near-term direction of the market,” with S&P 500 options activity linked to the announcement pricing in more potential movement for the index than for weighty economic reports like the consumer price index or the Federal Reserve’s interest rate decision.

Key Background

With a market capitalization of $3.5 trillion, Nvidia is the most valuable company in the world, outstripping the likes of longer established stalwarts like Apple and Microsoft. Nvidia has become a Wall Street darling, with its share price up more than 830% over the past two years, providing more than twice the return on investment as the next closest company listed on the S&P for the entirety of the timeframe, Facebook parent Meta at 400%.

The 31-year-old Nvidia traces its history back to humble origins, with its three cofounders coming up with the idea of the company at a booth of a Denny’s diner in Silicon Valley. One of those cofounders, Jensen Huang, a former Denny’s busboy and Nvidia’s chief executive since that fateful day, is now one of the 10 richest people in the world, with a $127 billion net worth, according to Forbes’ estimates.