More than a dozen tech billionaires on The Forbes 400 sold more than $15 billion worth of stock so far this year, with one person counting for more than half. Here’s who sold the most.

In November of last year, Amazon founder Jeff Bezos announced a move from Washington to sunny, tax-friendly Florida, splashing out $234 million on three properties in Miami’s “billionaire bunker” in the process. Bezos moved to be near family and his space company Blue Origin’s headquarters, he said at the time.

Then came the stock sales. Between February and July, Bezos offloaded more than $8 billion worth of Amazon shares, after not selling any stock since 2021. Notably, the state of Washington’s new tax on capital gains, including stock sales, went into effect in January 2022 while Florida has none. A representative for Bezos did not respond to a request for comment.

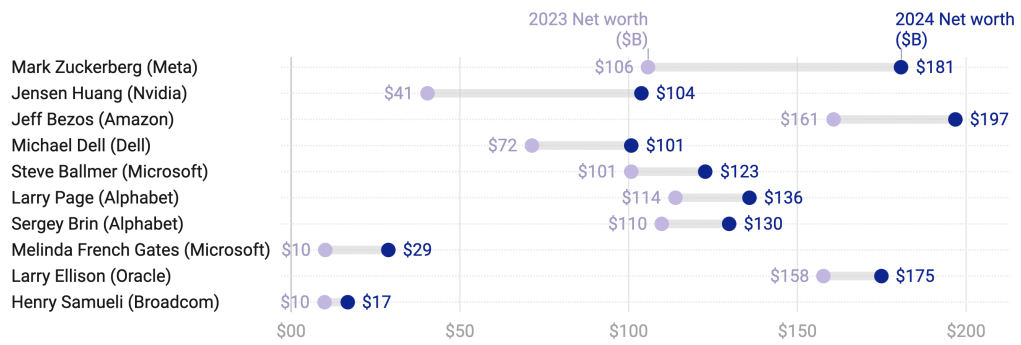

It’s not just Bezos who is on a selling spree. As a group, the technology billionaires on The Forbes 400 ranking of America’s wealthiest people are richer than ever, worth $1.8 trillion—up more than $350 billion from last year, despite sales. With public market optimism—largely driven by hype around artificial intelligence—running high, and much of Big Tech worth more than ever, many billionaires have been cashing out big chunks of their stock lately, likely taking advantage of the lofty valuations.

Forbes looked through the stock sales of all 24 tech billionaires on the Forbes 400 who are required to disclose stock sales due to holding an executive position, board seat or large percentage of ownership that sold shares this year. We didn’t count shares sold solely to help pay billionaires’ taxes on additional equity grants or shares sold by their philanthropic vehicles. Altogether, they have sold $15 billion of shares from January 1 to September 1 this year, the day we locked in net worths for The Forbes 400. Seventeen of these billionaires have unloaded at least $100 million of stock each.

Related

Nearly all of the sales happened via trading plans filed with the Securities and Exchange Commission months beforehand, per a rule designed as a defense against insider trading accusations. But billionaire stock selling often aligns with broader macroeconomic trends, since the terms of the trading plans—including how often, how much and when to sell stock—are largely up to the billionaire.

Most of this year’s big sellers, like Bezos (who ranks No. 2 on the 2024 Forbes 400), seem to be timing the market. Many paused their stock sales after the 2021 run-up, held onto their stock as the tech market cratered in 2022, benefitted from the major rebound in share prices in 2023—and are now taking some money off the table.

The better market conditions, along with some fear that capital gains taxes could increase in the next couple of years, help explain why billionaires are more likely to sell now compared to two years ago, according to Edward Renn, a longtime lawyer at Withers, which specializes in representing high-net-worth individuals. Still, Renn adds that billionaires’ selling is “usually driven by their own life choices” or specific business events and not “lack of faith in a company.”

For example, Michael Dell (No. 12) scored his biggest payday ever in November, when Broadcom’s acquisition of Dell Technologies spinoff VMware put an estimated $33 billion in cash and stock in Dell’s pockets. It seems Dell wanted even more cash, so he began unloading shares of Dell Technologies, too—more than $2 billion worth, after not selling a single share since 2021. He is the most notable seller who did not file a trading plan ahead of time. (A representative for Dell declined to specify why Dell sold the stock; some was likely part of the $4-plus billion he put into his charitable vehicles this year.) Meta CEO Mark Zuckerberg (No. 3) and Nvidia CEO Jensen Huang (No. 11) have also been trimming their stakes, to the tune of $940 million and $590 million in sales, respectively. And Oracle cofounder Larry Ellison, meanwhile, sold $230 million of stock, mainly after exercising options that were set to expire. Of course, all three of them are worth much more this year than they were a year ago, even with the sales, meaning the portion of their fortunes in their company stocks is only higher.

Crypto bull Michael Saylor—who sold the highest percentage of his net worth of any tech billionaire on The Forbes 400, at 8.4%—reportedly unloaded MicroStrategy shares in part to cover some personal debts and in part to buy more bitcoin.

All of the $100-million-plus tech stock sellers on The Forbes 400 hold large equity positions in a single company—doing “exactly what financial planners would tell most people not to do, which is having all your eggs in one basket” and could well be just trying to diversify and have some cash on hand, says Renn. Several billionaires likely sold stock to diversify their portfolios, a common financial move for many billionaires, whose fortunes are often heavily concentrated in shares of the companies that made them ultra-rich. And sales are likely to continue as long as market valuations stay up, according to Scott Welch, chief investment officer of multifamily office Certuity.

Take Bezos, for example: in March, he filed a trading plan saying that he will sell 25 million Amazon shares by the end of 2025. He has more than 16 million shares—worth some $3 billion at current share prices—to go.

Tech Billionaires Added $350 Billion to Their Wealth In 2024

The ten tech billionaires on The Forbes 400 whose fortunes have increased the most this year all have concentrated stakes in one public company. With the higher share prices this year came more stock sales. it makes sense that some are cashing out now: trading plans they file with the SEC often trigger automatic sales when share prices are above a certain target.

Here are the tech billionaires on The Forbes 400 who sold the most stock from January 1, 2024 through September 1, 2024 this year:

1. Jeff Bezos

Net worth: $197 billion | Source of wealth: Amazon | Stock sold: $8.2 billion of Amazon

2. Michael Dell

Net worth: $101 billion | Source of wealth: Dell Technologies | Shares sold: $2.1 billion of Dell

3. Mark Zuckerberg

Net worth: $181 billion | Source of wealth: Meta | Shares sold: $940 million of Meta

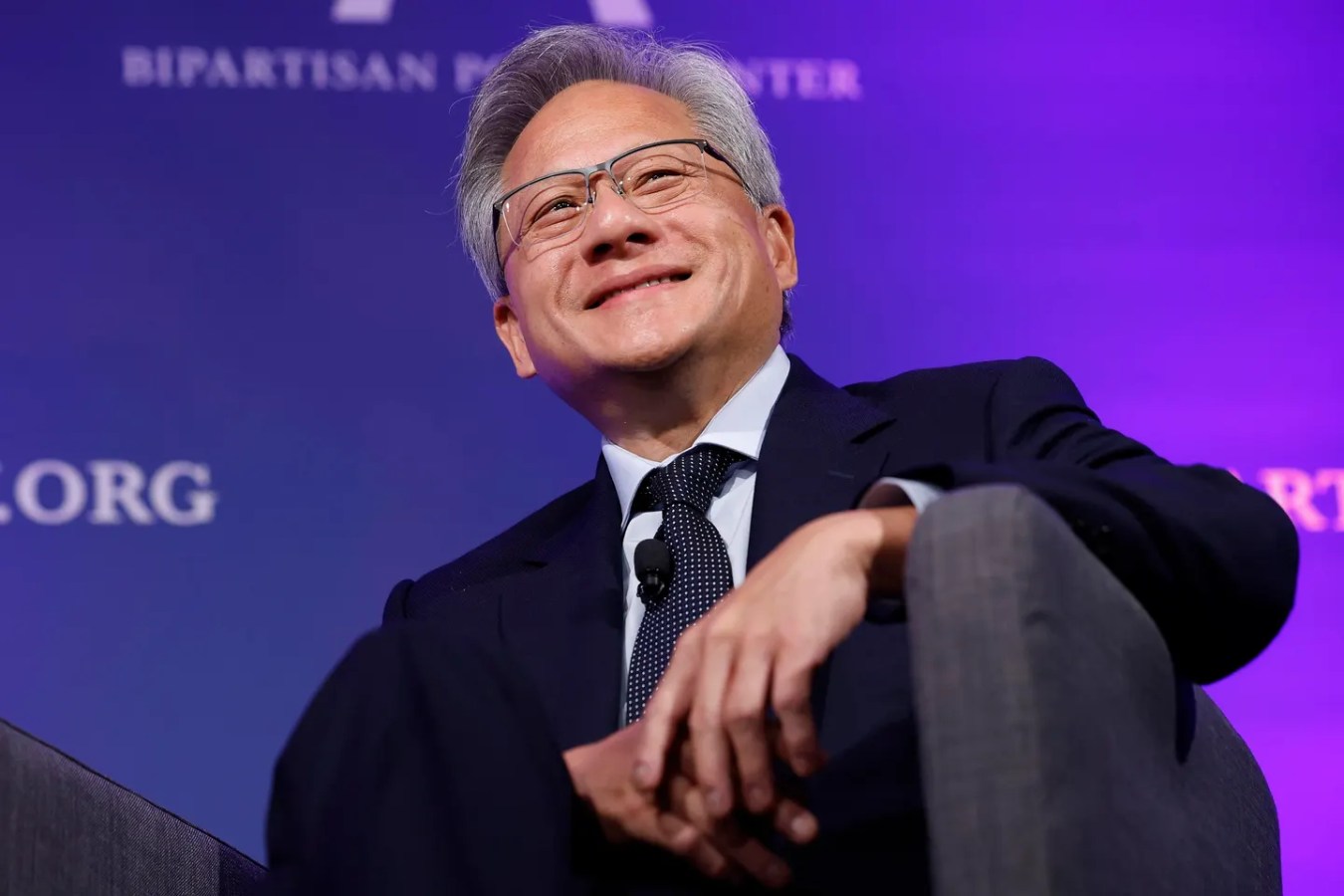

4. Jensen Huang

Net worth: $104 billion | Source of wealth: Nvidia | Shares sold: $590 million of Nvidia

5. Marc Benioff

Net worth: $9.1 billion | Source of wealth: Salesforce | Shares sold: $540 million of Salesforce

6. Michael Saylor

Net worth: $3.9 billion | Source of wealth: Cryptocurrency | Shares sold: $330 million of Microstrategy

7. Scott Cook

Net worth: $6.7 billion | Source of wealth: Software | Shares sold: $250 million of Intuit

8. Larry Page

Net worth: $136 billion | Source of wealth: Alphabet | Shares sold: $240 million of Alphabet

9. Larry Ellison

Net worth: $175 billion | Source of wealth: Oracle | Shares sold: $230 million of Oracle

10. Jayshree Ullal

Net worth: $4.4 billion | Source of wealth: Computer networking | Shares sold: $210 million of Arista Networks

11. David Duffield

Net worth: $14.3 billion | Source of wealth: Business software | Shares sold: $210 million of Workday

12. Brian Chesky

Net worth: $8.1 billion | Source of wealth: Airbnb | Shares sold: $200 million of Airbnb

13. Rick Cohen & family

Net worth: $10.4 billion | Source of wealth: Warehouse automation | Shares sold: $190 million of Symbotic

14. Joe Gebbia

Net worth: $7.5 billion | Source of wealth: Airbnb | Shares sold: $150 million of Airbnb

15. Sergey Brin

Net worth: $130 billion | Source of wealth: Alphabet | Shares sold: $130 million of Alphabet

16. John Bicket

Net worth: $4.6 billion | Source of wealth: Sensor systems | Shares sold: $130 million of Samsara

17. Sanjit Biswas

Net worth: $4.7 billion | Source of wealth: Sensor systems | Shares sold: $130 million of Samsara

This article was originally published on forbes.com and all figures are in USD.