Plenty of rich people have blown fortunes on politics. But no other American has used politics to create as much personal wealth as the 45th president, who left office with a new asset — throngs of people willing to buy almost anything from him, at virtually any price.

Donald Trump has built his entire brand around being a winner. But on January 20, 2021, he looked very much the opposite in every way possible. Defeated by voters, then impeached a second time after the Capitol riot he had fomented, Trump arrived back in Palm Beach, Florida, to an empire in distress. His commercial real estate was largely empty, his hotel business bleeding tens of millions, his licensing ventures at a standstill.

A week later, Trump welcomed Wes Moss and Andy Litinsky, former Apprentice contestants, to his private club for a business pitch. Alongside hamburgers and ice cream, the apprentices presented something that piqued the interest of the master: a Trump-branded media and technology company, complete with a social media app like Twitter, a streaming service like Disney+ and a web-hosting platform like Amazon. The most alluring part of the proposal? Trump would get 90% of the equity—and, according to someone involved in the deal, did not have to invest a thing upfront.

So began a four-year transformation that turned America’s most famous real estate billionaire into the first American ever to create billions from his politics. Other rich people have run for office, and many, many politicians—including every living ex-president—have leveraged fame and contacts into post-career riches. But no one has cashed in the way, or on the scale, that Trump has.

In early 2021, Forbes estimated that Trump was worth $2.4 billion, with $1.4 billion tied up in traditional commercial property, $1 billion of that concentrated in New York City. Today he returns to The Forbes 400 with an estimated net worth of $4.3 billion, the majority—$2.2 billion as of August 30, the day we locked in values for the list—stemming from the social media business, which went public in March. Just $600 million is now in New York commercial real estate. In less than four years, he has grown and completely transformed a fortune that he built over 40 years.

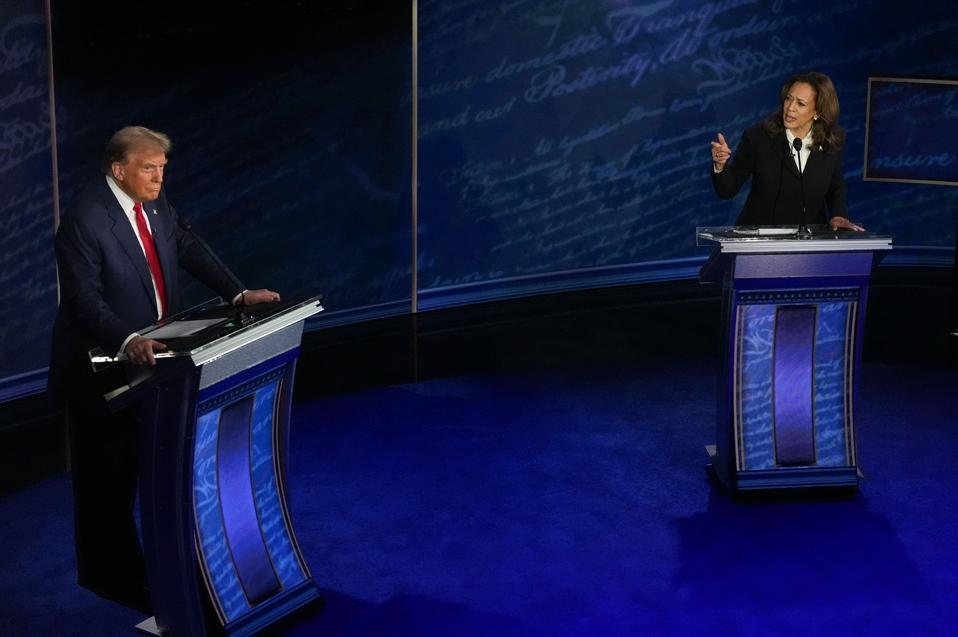

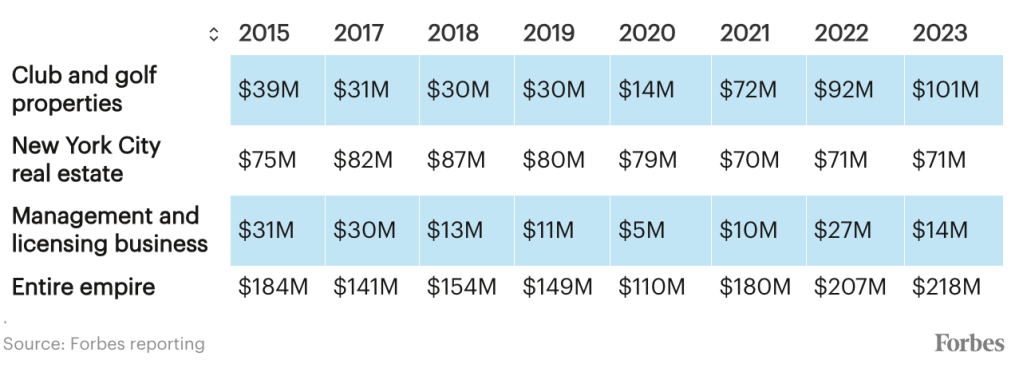

The presidency surely boosted Trump’s profits in his core ventures, helping lift his operating income to an estimated $218 million last year, 58% higher than what he averaged while he was in the White House, according to an analysis of tax returns, financial disclosures, bond filings, credit reports and internal records. Once a middling part of his empire, his golf and club business has become a cash gusher, a way to literally sell access to the most famous man on earth in the form of sky-high initiation fees. Forbes estimates that segment of his holding is now worth $1.1 billion, versus $570 million when he left office, as profits roughly tripled. Also adding to his bottom line: a random assortment of internet-fueled hucksterism encompassing coffee table books, NFTs, Bibles, even bits of the suit he wore to debate Joe Biden in June.

New Empire

Spooked by Donald Trump’s political rhetoric, corporate licensing partners have distanced themselves from him, while rich individuals have drawn closer. The result? His Palm Beach club and 14 golf properties now generate even bigger estimated profits than all of his New York City real estate.

What’s Trump really selling? Himself. He has done it for decades, as a 30-something living the high life in Trump Tower, as a 40-something spending big in Atlantic City, as a 50-something dominating a television boardroom, as a 60-something storming into politics and, now, as a 70-something seeking revenge. Through the ups and downs, one thing remains consistent: He gains the trust of people who don’t analyze him too closely, then cashes in. Just ask the lenders he never repaid. Or the casino shareholders who watched him pilfer a publicly traded company for cash, then steer it into bankruptcy—twice. Or the condo buyers who lost fortunes on flashy units in his Chicago tower while he siphoned millions in management fees. When Trump fails, he doesn’t give up—he just finds a new pitch, and often a new audience. In politics, he has developed an enormous group of followers, the most hardcore of whom are more loyal than any of his previous customers, eagerly buying whatever the former president offers, at almost any price he’s willing to sell.

That all comes together, at unprecedented scale, through the Trump Media & Technology Group, the parent company to Twitter knockoff Truth Social. From a financial standpoint, it’s one of the most absurd businesses in America, generating sales of just $3.4 million in the 12 months through June and recording a net loss of $380 million. Believe it or not, that revenue figure is actually down nearly 10 percent over the past year, even as the eponymous majority owner dominates most news cycles. It has no clear business case now that Elon Musk owns X (formerly Twitter), seemingly eliminating the need for a right-wing alternative. It does not have an inspiring leader—chief executive Devin Nunes, who previously worked in farming and government, sold about a quarter of his shares in August to cover tax payments. Yet Trump-loving traders still valued the business at $3.8 billion at the end of last month (and $3.1 billion when markets closed Tuesday). If someone other than Trump were behind the company, investors would probably peg it near zero.

The Trump Media & Technology Group, which is currently suing Forbes and other media outlets over past reporting, did not provide answers to a list of questions for this story. Instead, a representative accused Forbes of trying to boost Kamala Harris’ election prospects.

Just as politics changed Trump, he changed politics, rewriting the rules for how to squeeze profits from the presidency. Only one person saw any of this coming. “It’s very possible,” the 45th president predicted in an interview with Fortune 24 years ago, “that I could be the first presidential candidate to run and make money on it.”

Things did not start off that way. Trump’s 2016 presidential campaign began inside Trump Tower, the most famous property in his portfolio, with the real estate mogul descending an escalator, then promptly setting American politics ablaze. “When Mexico sends its people, they’re not sending their best,” he declared, picking the first demographic fight of his campaign, with many more to come. “They’re bringing drugs. They’re bringing crime. They’re rapists. And some, I assume, are good people.” When Forbes visited him at Trump Tower a few months later, on a day that coincided with a huge crowd heavy on pious Latinos waiting to see Pope Francis parade by, Trump was booed loudly.

Trump joined his tech platform, Truth Social, 30 months ago but has only 7.7 million followers, less than one-tenth of his total on X, which he left for roughly three years before returning in August ahead of an interview with owner Elon Musk.

Anna Barclay/Getty Images

As he reshaped a brand known for luxury into one defined by divisiveness, such derision came at a cost: Operating profit dropped from an estimated $184 million in 2015 to $141 million in 2017. Product licensing partners fled, curtailing deals that put his name on ties, mattresses and shirts, costing the candidate an estimated $3 million a year. Hotel customers checked out too, causing profits to fall 74% at his hotel in Chicago. Just as income was drying up, his political expenses were increasing, eroding his cash pile. He spent $66 million on his 2016 campaign, won the election, then agreed to spend another $25 million days later to resolve fraud litigation involving Trump University. By the time he settled into the Oval Office, his balance sheet listed just $76 million in cash, less than half the $192 million he reported at the start of the campaign.

Power did little to help Trump’s finances—at least initially. He certainly tried to monetize the presidency, famously turning Mar-a-Lago into a “winter White House,” shifting millions of campaign dollars into his business, offering to have the G7 conference of global leaders meet at his golf resort and so on. None of that, however, made up for the damage that politics inflicted on the Trump brand. The dynamic was on full display inside the Trump International Hotel in Washington, D.C., with a lobby full of power players but not enough day-to-day travelers in the rooms above, resulting in year after year of losses. Across his entire portfolio, estimated operating income hovered around $150 million in 2018 and 2019, down roughly 18% from its pre-presidential level.

Eric Trump, who helped lead the family business while his father served as president, channeled his father in projecting that everything was going well. But unlike Dad, he also conceded the evident challenges. “Is the presidency beneficial?” Eric asked himself aloud while sitting behind his Trump Tower desk in early 2017. “You have to look at it both ways. If you’re talking about existing assets, they’re doing amazing. If you’re talking about as a whole, we’ve made sacrifices in order to allow him—and he has made sacrifices to allow him—to take the biggest office in the world.”

There was no brushing over the troubles once the pandemic hit, however. Trump’s estimated operating profit fell to a low of $110 million. His five wholly owned hotels recorded estimated losses of $23 million. More problematic: His commercial real estate holdings, where tenants locked into long leases remained amid the political turmoil, started to show signs of distress. The Trump Organization renegotiated its lease with Gucci, the anchor tenant in Trump Tower, slashing an estimated $7 million off the retailer’s rent. Occupancy dropped from 89% to 75% at 40 Wall Street as the building slipped toward going underwater. At the time Trump left office, he was worth an estimated $2.4 billion, down from roughly $4.5 billion the day he announced his 2016 campaign in the Trump Tower atrium. Eight months after his presidency ended, Trump officially dropped off The Forbes 400 for the first time in 25 years.

On October 20, 2021, about two weeks after he fell off The Forbes 400, Trump again played host to his apprentices at Mar-a-Lago. The club stood out as a bright spot during his presidency, as it became increasingly intertwined with politics. Some old-timers did not love the change and decided to leave, which actually benefited Trump. The more who dropped their membership, the more newcomers he could bring in, charging ever-increasing initiation fees. Freed from the White House, Trump centered his orbit in Mar-a-Lago and invited those who could write checks rumored to be approaching $1 million to join the extravaganza. His income statement showed a jump in initiation fees from $3 million in 2020 to $11 million in 2021, more than doubling profits to $15 million that year. Similar trends played out across his collection of golf courses, once an afterthought in his portfolio, which got a boost from the pandemic and suddenly started producing more than $40 million of estimated operating income annually, up from $17 million in 2020.

Despite all the new cash, he still wasn’t eager to invest much into his media startup. Burned by famous bankruptcies of decades prior, he became more cautious in old age. “Politics is great because you don’t spend any money,” he told Forbes in 2015, arguing that there was no way his net worth could have decreased. “You can’t make a bad deal, you understand.”

“I don’t want to sell my shares. I’m not going to sell my shares. I don’t need money.”

Such fiscal restraint left Moss and Litinsky, the former Apprentice contestants, searching for other investors. By late October, they had drummed up more than $6 million thanks to help from Roy Bailey, an old business associate of Rudy Giuliani’s, as well as Kenny Troutt, the multilevel-marketing billionaire based in Dallas, according to documents obtained by Forbes. Then, on that fateful day in October 2021, the apprentices returned to Mar-a-Lago with a guest, a wide-eyed financier named Patrick Orlando, who was positioned to provide nearly $300 million he had accumulated in a special purpose acquisition company.

Under giant chandeliers, Trump and Orlando signed documents setting up a SPAC deal that would merge Orlando’s publicly traded pile of cash with Trump’s private enterprise, prepping the Trump Media & Technology Group to go public despite hardly having an operating business. They were, in essence, just taking Trump himself public. They signed the papers, issued a press release and waited for the market to react. When the bell rang the next day, shares of the SPAC went wild—based on the prospect of a merger—eventually leaping from $10 to $175, briefly implying a post-merger valuation of some $30 billion. Orlando got to work raising $1 billion more from institutional investors. “You know, I really want to build a $100 billion company,” he told his partners, clutching a bottle of Veuve Clicquot. “I think this is the team to do it.”

He was wrong. The merger ended up tangled in a web of investigations. Orlando’s own SPAC fired him; then the Securities and Exchange Commission levied fraud charges. A business partner named Eric Swider stepped in, with considerably smaller ambitions. “The target here is getting a merger done,” he explained. “That’s it. That’s the single focus.”

Eventually, the SPAC settled its own issues with the SEC, moving forward with the merger by paying an $18 million fine. Shareholders hardly blinked, bidding up shares of the merged company the moment it started trading, on March 26, under the ticker DJT—the same symbol Trump used for the publicly traded casino company that he twice bankrupted. Shares jumped 59% in less than a day, boosting the value of Trump’s stake to $6.3 billion and lifting his overall fortune to $8.1 billion, the highest it had ever been.

Since then, the stock—and therefore Trump’s net worth—has fluctuated wildly, generally trending down as the reality of the actual business revealed itself. At the time markets closed on Tuesday, investors valued his shares at $1.9 billion, dropping Trump’s net worth to an estimated $3.9 billion from $4.3 billion a few weeks ago. But given that Trump invested next to nothing in the venture, he remains way ahead. At this point, the share price is so disconnected from the underlying financials of the company that the Trump Media & Technology Group’s performance is almost irrelevant. What matters most are the emotions of Trump’s followers. It is those emotions that will dictate how much he can squeeze out of his stake.

He seems to know his social media business is overvalued. Before the company went public, he himself said, on his financial disclosure report, that it was worth no more than $25 million. There’s no reason it should be more valuable today, given that its revenue has shrunk since then, and Trump’s likelihood of becoming the next president decreased after Joe Biden left the race. The business features an unusual structure that allows him to retain 55% voting control, even if he sells all but one of his 115 million shares. For months, his shares have been subject to restrictions that prevent him from selling, but those are set to expire any day now. Selling roughly 60% of the social media company all at once, or even in decent-sized chunks, could crater the share price—and leave him with less. His challenge: how to keep his most fervent supporters trusting that he’s committed to the company while simultaneously dumping shares on those same people.

He could need cash fast. Trump currently has an estimated $413 million of liquid assets on his balance sheet after selling a hotel in D.C. and a golf course in New York. But a New York judge, who found that the billionaire exaggerated his net worth in acquiring both properties, ruled that he must pay back profits from both deals, accounting for some of the $566 million that he owes in legal liabilities. The former president is appealing multiple cases.

In the meantime, he’s doing his best to help the stock price. “A lot of people think I’ll sell my shares—you know, they’re worth billions of dollars,” he told reporters last week. “But I don’t want to sell my shares. I’m not going to sell my shares. I don’t need money.” Ditching the shares anyway would be a deceitful move, but also one that could enable Trump to lock in the first billion-dollar payoff from politics in U.S. history, potentially cementing his long-term spot on The Forbes 400, a list he has obsessed over since its first edition in 1982. “Man is the most vicious of all animals,” he was quoted in that inaugural issue, “and life is a series of battles ending in victory or defeat.”

This article was originally published on forbes.com and all figures are in USD.