The buzzy chip firm’s CEO Jensen Huang isn’t the only one scoring big, thanks to Nvidia’s soaring shares.

By Phoebe Liu and Kerry A. Dolan, Forbes Staff

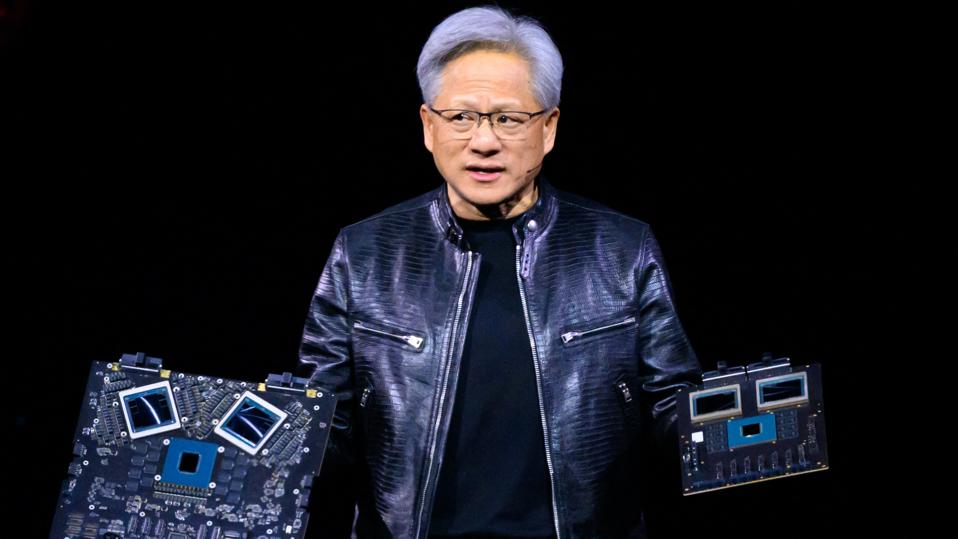

“The next industrial revolution has begun,” Nvidia cofounder and CEO Jensen Huang said last month, during Nvidia’s quarterly earnings call. “Companies and countries are partnering with Nvidia to shift the trillion-dollar installed base of traditional data centers to accelerated computing and build a new type of data center, AI factories, to produce a new commodity, artificial intelligence.”

No one has benefited more from Nvidia’s meteoric rise than Huang. Five years ago he was worth an estimated $4 billion, ranked No. 546 richest on Forbes’ World Billionaires list. Just over a year ago he was worth $21 billion, ranked No. 76 in the world. Now, with Nvidia’s market capitalization surpassing $3.2 trillion, he’s No. 12 richest on Earth, worth $115 billion, mostly thanks to his nearly 4% stake in the company.

While Huang is the best known shareholder of Nvidia, there are plenty of others who have personally benefited from the rising stock. Among the biggest gainers are five other top executives including Chief Financial Officer Colette Kress and its general counsel, Tim Teter, plus four independent board members who together own more than $10 billion worth of stock.

One of those board members is billionaire Mark Stevens, who first got involved with Nvidia in 1993, the same year the fledgling chip company was founded. He was a newish partner at Sequoia when the firm’s founder, Don Valentine, got a call from LSI Logic founder Wilfred “Wilf” Corrigan. “There’s this kid who works at LSI and I’m sorry to see him go. You guys should look at him,” Corrigan told Valentine, according to Stevens. Valentine and Stevens met with Huang, who pitched them on the idea of a company designing 3D graphics chips for PC games. “And we thought, intriguing,” says Stevens. Sequoia put $1 million into the company, part of an investment that valued the firm at just $7 million, according to PitchBook. Stevens, who had worked at Intel and was Sequoia’s young semiconductor expert, joined the Nvidia board. He left in 2006 at a time when Sequoia partners were stepping off public company boards to focus on private companies; in 2008, Stevens began to wind down at Sequoia and Huang invited him to rejoin the board. Largely because of Sequoia’s early investment, Stevens now owns $5 billion worth of Nvidia shares. But he says he doesn’t serve on the board for the money. “I love our board. I think it might be the best board in America.”

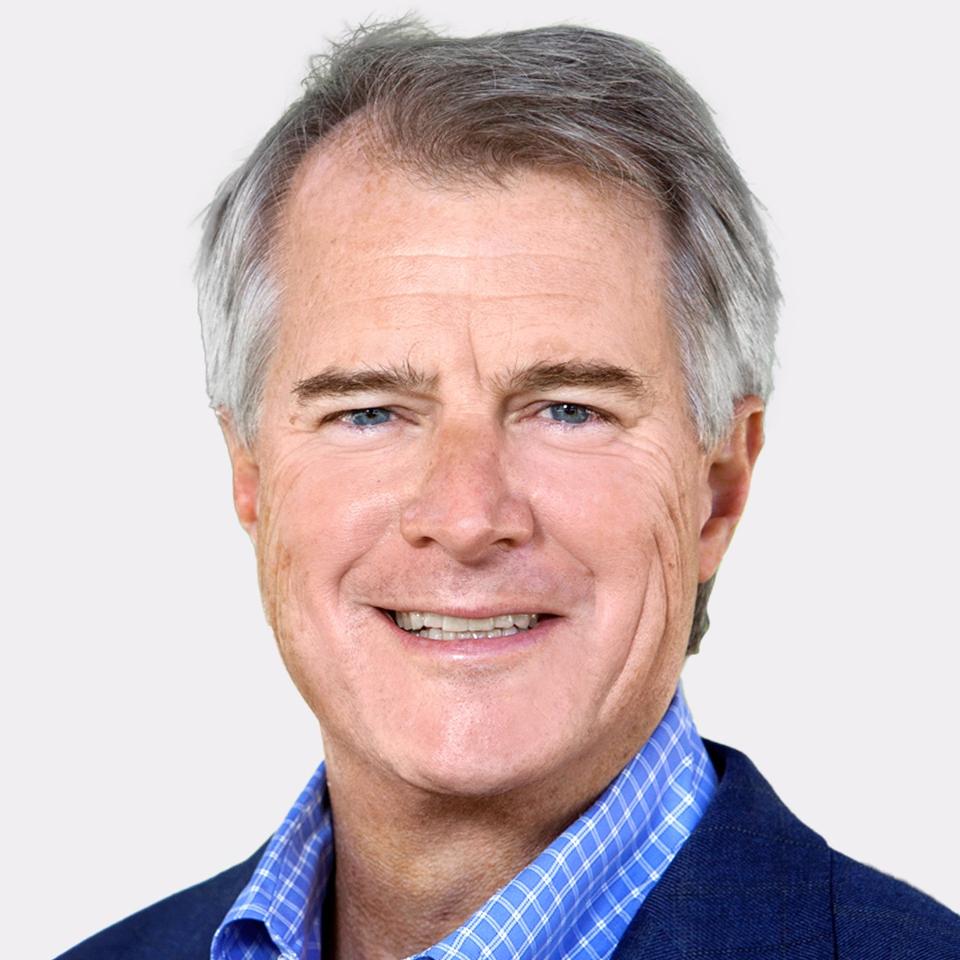

Current venture capitalist and former tech executive Brooke Seawell was convinced by another tech executive, Harvey Jones, to join Nvidia’s board in 1997. The two men got to know each other while Seawell was Senior Vice President of Finance & Operations at Synopsys, where Jones was CEO. Nvidia “was in the graphics semiconductor space, which was a hyper-competitive space … and the CEO was barely over 30. He hadn’t even been a VP before he founded the company,” Seawell recalls. “I looked at it and said, ‘Boy, this doesn’t seem likely.’” However, Jones, who’d joined the board in 1993, was persuasive, and Nvidia was in search of someone with expertise in finance and taking a company public, which Seawell had done at Synopsys. Seawell now owns $700 million of its shares.

Relatively speaking, the directors and executives at Nvidia own a lot of stock. At Microsoft, the most valuable U.S. company right now (with a $3.3 trillion market cap), directors and executive officers together own less than 1% of the software giant’s shares, per its latest proxy. The same is true at Apple, which has the second largest market cap, at $3.3 trillion. At Nvidia, directors and executive officers owned 4.23% of shares as of March 25, per its proxy filing. Altogether, that’s more than $130 billion worth of shares, though the vast majority of that is in the hands of Huang. One big reason for the shareholding difference is that, unlike Nvidia, none of the founders of Microsoft or Apple still serve on the board or as senior executives.

Benjamin Hermalin, a professor of finance at U.C. Berkeley, says via email that there are two broad effects of executives holding large amounts of stock, as Huang does. “First, managerial stock ownership makes management more concerned with the firm’s value (stock price), which is a positive for the other shareholders,” all other things being equal. But it could also make the team too cautious, knowing that so much of their money is tied up in the stock.

So far there are few signs that Huang is becoming risk averse.

Meanwhile, it’s pretty easy to see now why these board members as well as key insiders held onto so much stock, at least until these record highs. But earlier on, it wasn’t so obvious. Nvidia’s first chip, released in 1995, had failed. Partway through developing its second chip, Huang and team decided the architecture was all wrong and they stopped work on it, according to a podcast from VC firm Sequoia. “Between 1993 and 1997 we almost went bankrupt three times,” says board member Stevens. “One of the things that Jensen said was ‘We’re only 30 days from going out of business.’”

Nvidia turned things around by working in reverse on its third attempt to design a chip, tackling the software first, Huang explains on the Sequoia podcast. It moved quickly due to evaporating funding, and its next chip was a success. In the early 2000s it developed the world’s first graphics processing unit, or GPU, which became hugely popular for rendering images in video games. In the past decade or so, Nvidia found that AI researchers in both the corporate and academic worlds were using its GPUs to run neural networks–a foundation of AI–and to create home-grown supercomputers. That helped fuel the decision to bet on AI computing, before there was a demonstrated market. That bet has paid off in spades.

One person who missed out on billions is Huang’s cofounder and former chief technology officer, Curtis Priem—who had the same number of shares as Huang when Nvidia went public in 1999, but left the company more than 20 years ago. Had he held onto his stock, he could have been a centibillionaire. Priem either sold or donated all of his Nvidia shares by 2007, he told Forbes last year, and is funding a quantum computer worth triple his current estimated net worth of under $50 million. It’s not clear what cofounder and former vice president of engineering Chris Malachowsky has done with his Nvidia shares since leaving two decades ago. He hasn’t been required to disclose his Nvidia sales or holdings since 2002, when he held 773 million shares (adjusted for splits). Attempts to reach Malachowsky were unsuccessful.

The company didn’t miss a beat after the cofounders left. Seawell, who’s been on the Nvidia board for nearly 27 years, credits Huang’s leadership for steering the business so steadily. “AI has been a concept for many, many decades. But Jensen saw that with enough compute power, it could become practical and real,” says Seawell. Huang spends part of his time not just on the technology, but focusing on teamwork and helping employees do work they are passionate about, which in turn has led to very low employee turnover—just 3% a year, per Seawell, compared to 15% at most Silicon Valley companies.

Says Seawell: “Jensen will be the first person to say we’ve had lots of ups and downs, and we’ve made tons of mistakes. But we’ve learned from our mistakes, and we constantly get better.”

Here are the 10 current Nvidia directors and executives who have gotten the richest from Nvidia holdings and share sales, up a cumulative $36 billion in the past month:

Net worths and share values are as of Friday, June 14. Cash is net of estimated taxes, appreciated annually.

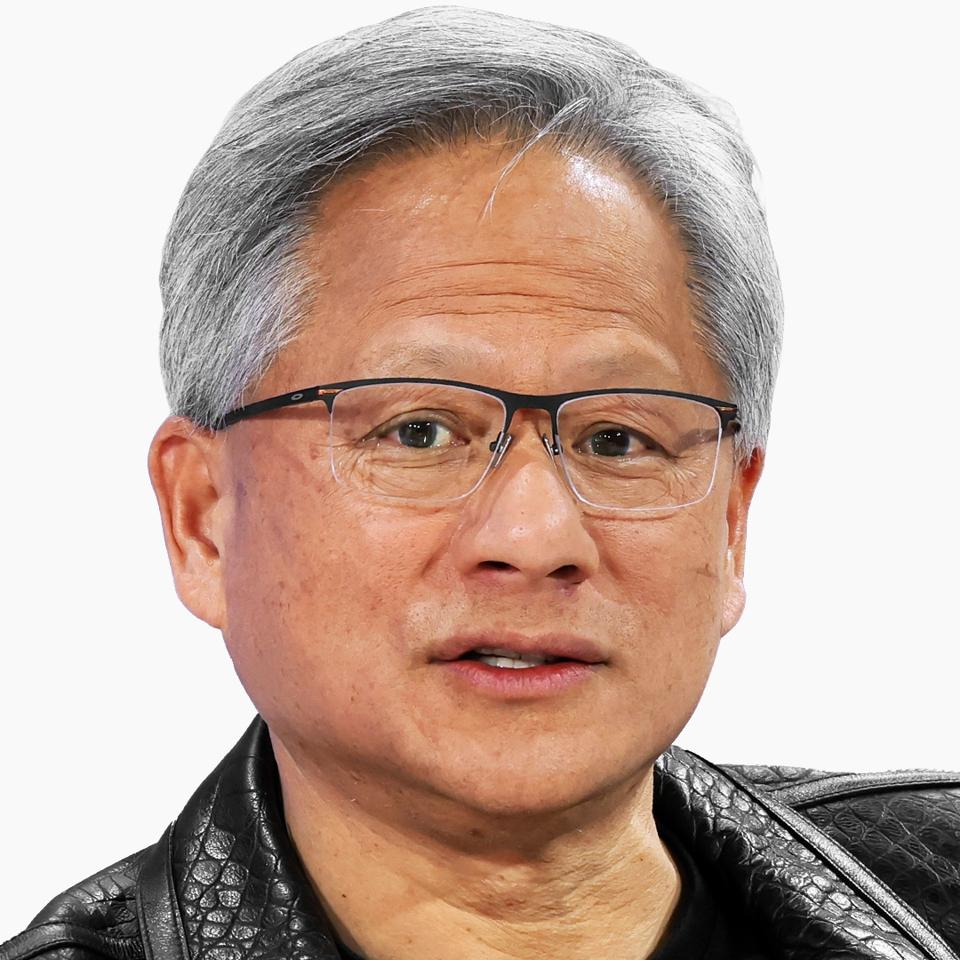

1. Jensen Huang

Nvidia CEO | Net worth: $115 billion | Current value of Nvidia shares: $114 billion | Estimated cash from NVDA share sales: $1.5 billion

Huang has come a long way from cleaning toilets in a rural Kentucky boarding school while he was a student. Even so, if he could do it all over again, he wouldn’t build Nvidia because he didn’t realize how hard it could be, he told the Acquired podcast in February. He says he’s always working, around the clock and seven days a week. “I sit through movies, and I don’t remember them because I’m thinking about work,” he said in an interview with Stripe cofounder Patrick Collison last month, during which he also mentioned that he doesn’t believe in one-on-one meetings or in firing employees. In March, Huang adopted a new trading plan to sell six million Nvidia shares, less than 1% of his stake, in the next year.

2. Mark Stevens

Nvidia board member | Net worth: $8.7 billion | Current value of Nvidia shares: $5.2 billion | Estimated cash from NVDA share sales: $400 million

Longtime venture capitalist Stevens was a partner at Sequoia Capital when the firm invested in PayPal, LinkedIn, Google and, of course, Nvidia—back in 1993, when Nvidia was founded and the entire company was worth just $7 million, according to PitchBook. He served on Nvidia’s board from 1993 to 2006, and then rejoined again two years later. Stevens, who sold more than $120 million worth of shares in the last month, also owns a minority stake in the Golden State Warriors, where he is a member of the ownership’s executive board. He left Sequoia in 2021, and now primarily invests through his own firm, S-Cubed Capital.

3. Tench Coxe

Nvidia board member | Net worth: $5.7 billion | Current value of Nvidia shares: $4.8 billion | Estimated cash from NVDA share sales: $400 million

Like Stevens, Coxe was a VC, representing early investor Sutter Hill Ventures. He too joined Nvidia’s board the year the company was founded. While he left Sutter in 2020, he never left Nvidia, and is now entering his fourth decade as a director. Coxe is the third-largest insider shareholder at the firm. He has also been a shareholder at software firm Snowflake, which Sutter Hill backed.

4. Harvey Jones

Nvidia board member | Net worth: $1.4 billion | Current value of Nvidia shares: $1 billion | Estimated cash from NVDA share sales: $300 million

Jones, who joined Nvidia’s board with Stevens and Coxe in 1993, has been an entrepreneur, high tech executive and venture investor for more than three decades. He cofounded tech companies Daisy Systems in 1981 and Tensilica in 1997—and served as CEO of electronic design automation company Synopsys, which is now worth more than $80 billion. These days, he is primarily an investor through his firm, Square Wave Ventures.

5. Colette Kress

Nvidia Chief Financial Officer | Current value of Nvidia shares: $700 million | Estimated cash from NVDA share sales: $50 million

Nvidia’s executive vice president and chief financial officer, Kress joined the tech outfit Nvidia in 2013, when revenue was just $4.3 billion. She has since helped oversee one of the biggest revenue ramp-ups in history: in the year through January, Nvidia had $60.9 billion in revenue, 15 times what it was a decade ago. Kress reportedly joined Nvidia after the endorsement of her two young sons, 8 and 10 at the time, who knew the company for designing the chips that powered their favorite computer games. (Each of her sons now has 400 shares to their name.) Prior to Nvidia, Kress spent three years as CFO of a Cisco division and 13 years at Microsoft.

6. Brooke Seawell

Nvidia board member | Current value of Nvidia shares: $700 million | Estimated cash from NVDA share sales: $60 million

Seawell joined Nvidia’s board back in 1997 when he was executive vice president at NetDynamics, an application server software company acquired in 1998 by Sun Microsystems. He pivoted to venture capital in 2000, first as a partner at Technology Crossover Ventures and later at New Enterprise Associates. Over his long career—25 years as an operating executive and nearly as many as a VC, he’s been involved in 12 public offerings including Nvidia and data visualization company Tableau, as well as 13 acquisitions. Seawell is also an avid cyclist who has taken two dozen cycling vacations around the world. According to him, “It’s an in-depth way to experience a place or region.”

7. Jay Puri

Nvidia executive vice president | Current value of Nvidia shares: $500 million | Estimated cash from NVDA share sales: $150 million

Longtime Nvidia employee Puri is now an executive vice president responsible for the company’s worldwide field operations including its go-to-market strategy. Before joining Nvidia in 2005, he spent 22 years at Sun Microsystems—where Nvidia cofounders Priem and Malachowsky also worked before leaving to create Nvidia.

8. Tim Teter

Nvidia General Counsel | Current value of Nvidia shares: $300 million | Estimated cash from NVDA share sales: None

Nvidia’s general counsel joined in 2017 and has already amassed Nvidia shares worth more than a quarter of billion dollars. Previously, he was a partner at law firm Cooley, where he worked on high-profile patent and tech cases representing companies including Qualcomm and Apple. Before heading to law school at Stanford, he worked as an engineer at Lockheed Missiles and Space Company. He has only disposed of shares as gifts or to cover taxes owed for the vesting of restricted stock units.

9. Debora Shoquist

Nvidia Executive Vice President | Current value of Nvidia shares: $200 million | Estimated cash from NVDA share sales: $130 million

She joined Nvidia in 2007 and is now executive vice president of operations, which includes overseeing Nvidia’s 1.25-million-square-foot headquarters in Santa Clara. Shoquist has sold a bigger percentage of her shares relative to her current holdings than any of the other top Nvidia holders. She previously worked at JDS Uniphase, Coherent and Quantum.

10. Mark Perry

Current value of Nvidia shares: $200 million | Estimated cash from NVDA share sales: $40 million

An independent Nvidia board member since 2005, Perry has held a wide variety of titles in various industries, including general counsel, chief financial officer and executive vice president of operations at public biotech giant Gilead Sciences. He also had a stint at law firm Cooley, was briefly an entrepreneur-in residence at Third Rock Ventures and was CEO of biopharma firm Aerovance. He currently consults for various companies and nonprofit organisations.

This article was originally published on forbes.com and all figures are in USD.

Are you – or is someone you know – creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 15, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.