Hundreds of billionaires are poorer since Trump took office. Here are the few who have lost—or gained—the most.

“This is what victory feels like,” Elon Musk declared the day Donald Trump was sworn in. “I’m super fired up for the future…One of the most American values that I love is optimism.”

Now, as Donald Trump begins his 100th day back in office, much of the optimism has faded as the American stock market has gotten off to its worst start in 50 years, with the S&P 500 and Dow Jones Industrial Average both dropping by nearly 8% amid Trump’s tariff war.

No one has been hit harder than Musk, who is $45 billion poorer than he was on Trump’s second inauguration day. Musk has taken to feuding with Trump tariff hawk Peter Navarro on social media, has said he will step back from leading Trump’s Department of Government Efficiency, and has had to refocus on his electric carmaker Tesla, after tariff fears and Musk’s increasingly unpopular political efforts have sent the stock crashing 33%.

He isn’t the only billionaire down big during Trump 2.0. Overall, America’s 800-some billionaires are $300 billion poorer since January 20. Joining Musk among the 10 biggest losers (in sheer dollar terms) are Amazon’s Jeff Bezos, Alphabet’s Sergey Brin and Meta’s Mark Zuckerberg, three tech tycoons who scored prominent seats just behind the first family at Trump’s inauguration—and have since gone on to lose $35 billion, $26 billion and $22 billion in wealth, respectively.

Other prominent Trump backers have dropped billions, too. Oracle’s Larry Ellison—who met with Trump the day after the inauguration as part of a $500 billion an AI infrastructure initiative—is America’s third-biggest loser so far, behind Musk and Bezos, down $28 billion. Blackstone cofounder Stephen Schwarzman, who initially said he would not support longtime friend’s 2024 campaign but soon backtracked, is $11 billion poorer.

Of course some billionaires have managed to get richer despite the shaky markets. Warren Buffett—who called tariffs “an act of war, to some degree” ahead of Trump’s announcement—has kept Berkshire Hathaway steady, stashing a record $334 billion of the conglomerate’s money in cash and cash equivalents. That has helped push shares up 13% since Trump took office, adding nearly $20 billion to the Oracle of Omaha’s net worth. Other big billionaire winners so far: Peter Thiel (up $4.9 billion) and Alexander Karp ($3.6 billion), whose AI-powered data mining firm Palantir is America’s hottest stock, thanks in part to defense and software contracts with U.S. government agencies. The three surviving children of Walmart founder Sam Walton (d. 1992), meanwhile, are each at least $3 billion richer, as consumers have flocked to the retail giant amid elevated inflation; last week, Walmart CEO Doug McMillon met with Trump to argue against tariffs. And while former Microsoft CEO Steve Ballmer, who has kept much of his wealth in the tech giant’s stock, losing $8 billion so far in the process, founder Bill Gates has diversified his fortune into a wide range of investments, including a 35% stake in waste company Republic Services (up 15%), helping make him a big gainer.

President Trump, meanwhile, has not been kind to businessman Trump. The commander-in-chief’s fortune is down $1.5 billion since he took charge of the U.S. government, as shares of his Trump Media & Technology Group—the parent company of Truth Social—have plunged by 35%, quadruple the broader market’s drop. He’s clearly paying attention to the gyrations. Standing in the Oval Office on April 9, Trump pointed to brokerage billionaire Charles Schwab: “He made $2.5 billion today,” he bragged, then turned to automotive billionaire Roger Penske: “And he made $900 million.” Both fortunes have continued to climb since then, but after racking up huge losses earlier in Trump’s first 100 days, Schwab is only $375 million, or 3%, richer than he was on the last day of Joe Biden’s presidency. Penske, meanwhile, is $1.1 billion poorer.

Here are the 10 biggest American losers and the 10 biggest American winners of Trump’s second presidency, as of his 100th day in office.

*Based on U.S. citizens with a majority of wealth held in public companies. Net worth changes measured from the market close on January 17, 2025 to the market close on April 28, 2025.

Biggest losers:

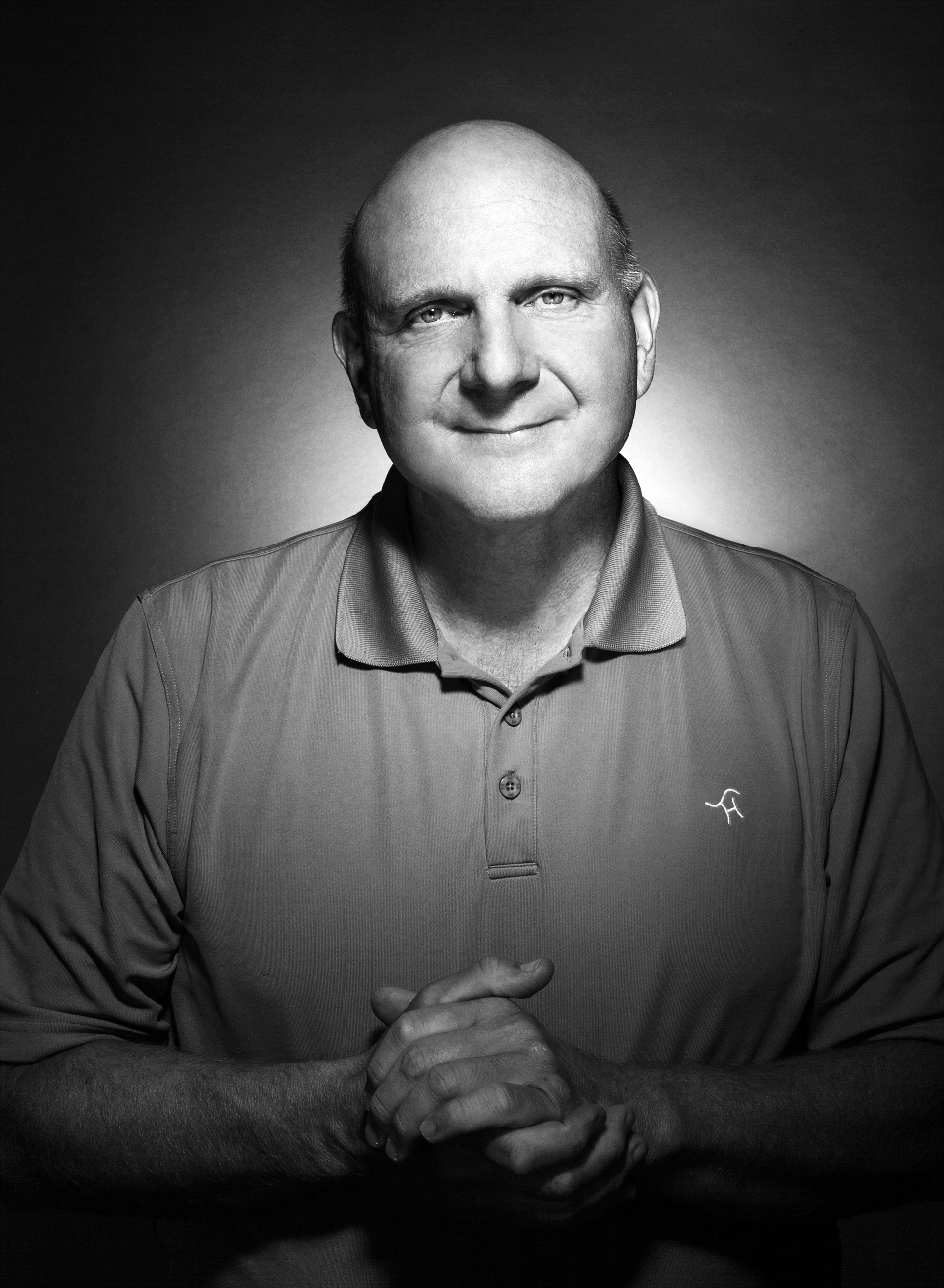

10. Steve Ballmer

Source of wealth: Microsoft

Net worth: $117.6 bil

Loss since Trump’s inauguration: -$8.4 bil

9. Stephen Schwarzman

Source of wealth: Blackstone

Net worth: $41.6 bil

Loss: -$10.9 bil

8. Michael Dell

Source of wealth: Dell Computers

Net worth: $98.2 bil

Loss: -$16.8 bil

7. Mark Zuckerberg

Source of wealth: Facebook

Net worth: $190.3 bil

Loss: -$21.5 bil

6. Jensen Huang

Source of wealth: Nvidia

Net worth: $95.2 bil

Loss: $24.9 bil

5. Sergey Brin

Source of wealth: Google

Net worth: $128.4 bil

Loss: -$25.6 bil

4. Larry Page

Source of wealth: Google

Net worth: $134 bil

Loss: -$27.4 bil

3. Larry Ellison

Source of wealth: Oracle

Net worth: $176.4 bil

Loss: -$28.2 bil

2. Jeff Bezos

Source of wealth: Amazon

Net worth: $204.6 bil

Loss: -$34.8 bil

1. Elon Musk

Source of wealth: Tesla, SpaceX

Net worth: $388.6 bil

Loss: -$45.3 bil

Biggest gainers:

10. Bill Gates

Source of wealth: Microsoft

Net worth: $108.9 bil

Gain: +$2.5 bil

9. Robert Duggan

Source of wealth: Pharmaceuticals

Net worth: $15.4 bil

Gain: +$2.9 bil

8. Alice Walton

Source of wealth: Walmart

Net worth: $104.4 bil

Gain: +$3 bil

7. Jim Walton & family

Source of wealth: Walmart

Net worth: $112.2 bil

Gain: +$3.1 bil

6. Rob Walton & family

Source of wealth: Walmart

Net worth: $113.4 bil

Gain: +$3.1 bil

5. Alexander Karp

Source of wealth: Palantir

Net worth: $10.6 bil

Gain: +$3.6 bil

4. Lin Bin

Source of wealth: Smartphones

Net worth: $15 bil

Gain: +$3.7 bil

3. Brad Jacobs

Source of wealth: Logistics

Net worth: $12.6 bil

Gain: +$4 bil

2. Peter Thiel

Source of wealth: Facebook, investments

Net worth: $19.3 bil

Gain: +$4.9 bil

1. Warren Buffett

Source of wealth: Berkshire Hathaway

Net worth: $165.8 bil

Gain: +$19.6 bil

This article was originally published on forbes.com and all figures are in USD.